Get ready for a fact that will blow you away. Ready? Did you know that women named Margaret win in bingo more often than women with any other name? For all my underprivileged players who got other names carelessly scribbled on their birth certificates, I got you.

How To Play Bingo – The Only Guide You’ll Ever Need

Who Called The First Bingo?

The first game of bingo, albeit a very different version of it, was traced back to 1500s Italy. It used to be called “Lo Giuoco del Lotto d’Italia”, and by the eighteenth century, it was already used in Germany and France for educational purposes to teach children spelling and multiplication tables, as well as a social game that was played with different tokens and playing cards.

The game first appeared in America at a travelling carnival, where toy salesman Edwin Lowe watched it being played with dried beans, a rubber band and cardboard sheets. Because of the dried beans, the game used to be called “Beano” back then. He took the idea back to New York, where it became a rapid hit with his friends.

It is said that one of the players was so excited to have won, that he shouted “Bingo” instead of “Beano” – thus naming what was going to be Lowe’s registered patent in 1942 and making history.

To find out more about the history of bingo you can read our guide here.

Bingo Around the World

While the exact moment when Bingo sailed to the UK is unknown, but what we know for certain is that following the 1960 Betting and Gaming Act, the game quickly becomes an unstoppable phenomenon. With the Act legalizing large real money prizes, the Kingdom swiftly saw the launch and rise of Mecca Bingo, led by Eric Morley, who had a large chain of dancehalls and introduced bingo into 60 of them. Fast forward to 2020, and we are told her majesty the Queen is a big fan of bingo and refuses to call “house”, but rather “Palace”.

Between classic bingo halls, televised game shows, and especially the rise of online bingo, we’ve seen more and more players have fun and win jackpots with more new online bingo sites open every year, so it makes sense trying to make the rules as clear as possible so that everyone can take part.

How to Play Bingo

Whether you like your bingo sessions in a hall, where you can socialize with your friends for a couple of hours, or you’re a fan of the solitary thrills online bingo can bring you, the game has the same main rules. The game further expands with little features and fun additions, especially for online bingo, but the main principle stays the same throughout them all.

A player will be prompted to buy a bingo card (or several), on which there will be a grid filled with random numbers. Depending on the type of bingo you play, the grid can vary in size. For example, 75-ball bingo, which is the most popular form of bingo in the United States, uses a 5×5 grid. The centre square of most bingo cards will be left blank.

During the game, a designated caller will draw bingo balls at random, and call the number on them out loud. Sometimes the balls have a combination of a number and letter, such as B7. The balls will, of course, always match the pairs on the cards. Depending on the type of bingo you play, the total number of balls that can be drawn varies. Generally, American bingo uses 75 balls, while British and Australian bingo use 90.

On a typical 75-ball bingo card, the first column will contain numbers between 1 and 15, the second one, 16 through 30, the third column, 31 through 45, while the last two will cover numbers 46 through 60 and 60 through 75.

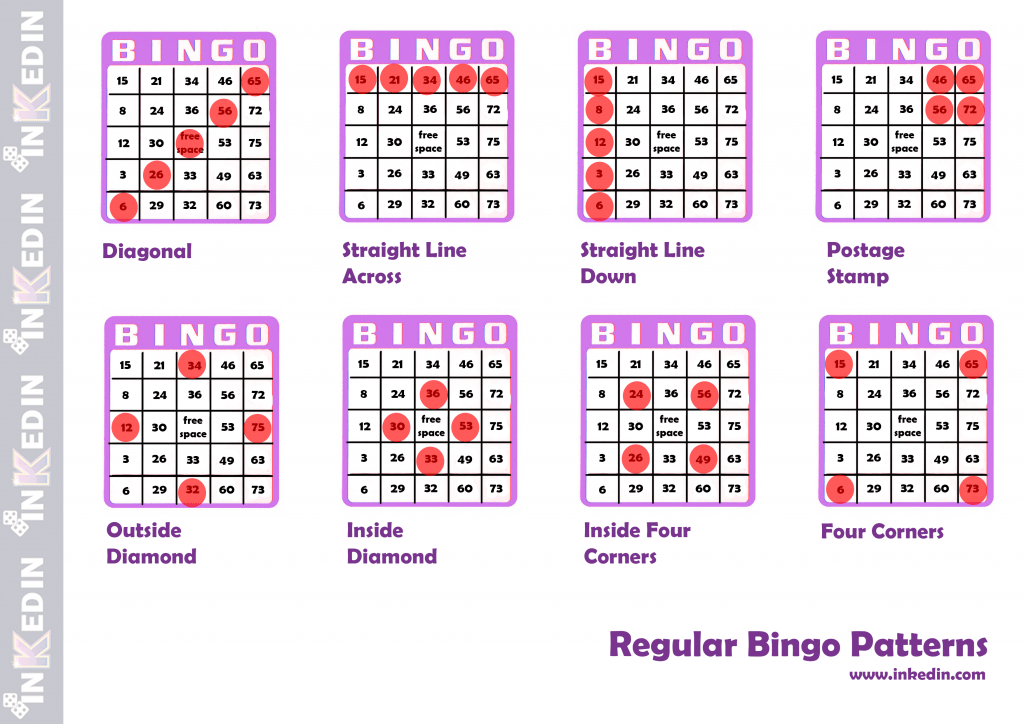

As the caller announces the numbered balls being drawn, players have to quickly mark them on their bingo card. A player wins by completing a row, column or diagonal. In addition to one of these lines, other patterns will be considered valid in special bingo games. For example, a player might be required to cover all four corners of the card or form a pyramid. The winning pattern will always be announced at the beginning of the game.

If you managed to cover the required pattern for your specific game, you will have to yell “Bingo” and validate your cards. Just make sure that you truly marked the correct pattern, because there are studies out there demonstrating that bingo players get pretty mad when someone calls “Bingo” erroneously.

Luckily, if you’re playing an online bingo game, awkward yelling is no longer necessary. You can still do it to annoy your neighbours. Just make sure to be extra loud.

Bingo Lingo

Before your first bingo session, let us go through the speciality lingo a bingo player might hear when playing offline bingo or during online gameplay.

- Bingo Ticket – a typical bingo ticket will contain 27 spaces, aligned in 9 columns and 3 rows. Each row contains five numbers and four blank spaces. Tickets are bought as strips of 6, which allows every number from 1 to 90 to appear on the ticket. This means a player that bought a ticket will be guaranteed to mark off a number every time a number is called.

- Blackout – a common pattern in which you have to mark the whole card to win.

- Consolation Prize – the prize or prizes offered on some special games if there is no winner on a progressive game.

- Bingo Dauber – an ink-filled bottle or pen with a foam tip used to mark numbers that have been called. When you touch the paper card with the bingo marker it marks the square.

- Early-Bird (Warm-Ups) – Early Bird games are regular length or shorter games that precede the main game.

- Hardway Line – Bingo in a straight line without the use of the free space.

- Jackpot – a big prize awarded for marking a difficult pattern, such as a blackout.

- Progressive Jackpot – a jackpot that gets bigger until someone wins it. The progressive jackpot will become bigger and bigger daily or weekly if it is not won in a number of calls.

- Bingo Session – the entire program in which the main game and special games of bingo are played. it usually lasts up to 3 hours.

- Full-house – covering all numbers on a ticket.

Which Bingo Game to Play?

So, you’re ready to go to a bingo hall or an online bingo site and buy your first card. However, the myriad of options is a bit overwhelming. More than 200 bingo sites are operating in the UK alone, and a lot of them come with their own bingo rules, fun winning pattern combinations and other enticing features such as a uniquely-themed bingo room every day of the week and a progressive jackpot that is paid out to a number of lucky players weekly or monthly.

Bingo games are categorized by how many bingo numbers will be drawn before the game ends. Here are all the types you may encounter while playing bingo.

30-ball bingo

This one is also called speed bingo, as it is the fastest bingo game out there. Cards for this game have 9 numbers and no free space, on a 3×3 grid. The game is played quicker than regular bingo games, and there is only one big prize given out to a full-house winner. You can play this type of game in some bingo halls and online on sites like Foxy Bingo and 888 Ladies.

40-ball bingo

Yet another fast-paced game, this one employs cards with just 8 spaces each. The squares are spread over 4 columns and 2 rows, and you could win either by marking off a line, 4 squares left to right or a full house. The most famous version of 40-ball bingo is probably Rainbow Riches that has a lot of built-in special features, making the game multi-layered and a lot more interesting. If you want to play Rainbow Riches or other similar games, you can find them at Gala Bingo or Paddy Power Bingo.

50-ball bingo

This game type is a new addition to the online space, and it is not usually played in halls. Unlike traditional bingo, this one is still a very fast-paced card game where you get 2 chances to win. Players buy a strip of 5 tickets, each containing 10 numbers arranged in 2 rows, with no free spaces. Although this game is very hard to come by in brick-and-mortar halls, you can easily play it online on sites like Gala Bingo and Wink Bingo.

52-ball bingo

This variation can only be played online as a new spin on the classic bingo game. It uses playing cards rather than bingo balls, hence there being 52, the number of cards in a traditional deck. The player will receive 5 cards and it is their job to get a bingo chip every time their card is called out. Cover all your cards with bingo chips as the caller announces them and you will be crowned winner of the game. You can find this bingo variant at sites like Sun Bingo and Mecca Bingo.

75-ball bingo

This version of bingo is most popular across the United States. The winner of this game will have marked a full row of numbers on their card, in any direction. The card for this bingo variant is a 5×5 grid, with the centre square marked off as a free space. You will have no issue playing this game in a bingo hall, but there are also several sites that carry exciting renditions. Check out this game at Heart Bingo or Kitty Bingo.

80-ball bingo

Arguably the most popular form of online bingo there is. This type of bingo uses 4×4 cards, with 16 total numbers. A player will win if they mark one special pattern marked on the card. People use several popular patterns when playing this game, such as 4 corners, single numbers, and many more. You can play this type of bingo almost anywhere on the internet, but we recommend the famous Costa Bingo and Wink Bingo.

90-ball bingo

The most popular version of bingo, this game is the most played variation in the UK. The 9×3 cards feature 15 total numbers; each game comes with 3 distinct winners. The first winner is the person completing a horizontal row, followed by the first person to mark off two full horizontal rows. The third winner is the one marking a full-house, and they will also receive the grand prize. You can play 90-ball bingo in most traditional bingo locations and on most bingo sites and online casinos. Try it for yourself on Ladbrokes Bingo or Lights Camera Bingo!

Takeaway

So we’ve gone over the basics, you met your first caller, and you’re ready to buy your first ticket. You approach your desired bingo medium and buy a card at first to get the hang of it. You get lost in the heat of the moment, and soon enough, you marked your first bingo pattern with your bingo dauber. You yell “bingo” and approach the caller to validate your winning card. You did not expect to have so much fun and win a prize on top of it, but here we are.

All of it was because one sunny afternoon, you decided to look up the whole fuss with bingo. You are now one of the 3 million people playing bingo more than twice a week in the UK alone.

Gambling trends might come and go, but it is safe to say that bingo is here to stay. It’s only gotten more and more popular over the years, and it’s still going strong more than 500 years after its inception.

Whether your eyes are on the jackpot prize or just looking for a thrilling way of spending your nights with your friends, you are all covered.