Although Bingo Street is not a new bingo site don’t be deterred as it still come with a range of great games and promotions.

This Grand Battery Holdings bingo site provides customers with a welcoming place to socialise with other players through chat rooms. While enjoying this community’s social aspects, customers have a range of exciting bingo and slot games to try out.

Being part of Grand Battery Holdings Ltd, Bingo Street is a trusted bingo site under the UK Gambling Commission’s jurisdictions.

There is plenty of bingo action to enjoy at Bingo Street, but before you make any commitments, why not read our detailed review of what this bingo site has to offer?

This review will take a closer look at what Bingo Street has to offer, including aspects such as payment methods for playing bingo, bingo games, slot games, promotions, security, and what Bingo Street bingo bonus is is up for grabs .

Welcome Offer & Sign Up Bonus

Bingo Bonuses excite customers the most and, more specifically, bingo bonus welcome offers. You can find welcome offers on every online gaming platform and a great way to attract new customers to their site.

New customers at Bingo Street can get their hands on one of the best bingo bonus offers that contains a 200% deposit match bonus of up to £200! Like any other welcome offer, Bingo Street’s offer requires customers to complete a couple of simple steps. Those looking to get their hands on this 200% deposit bingo bonus will first need to register an account with Bingo Street. Following this, Bingo Street requires a minimum deposit of £10 to be made.

Unfortunately, as you might expect, Bingo Street’s sign-up bingo bonus comes with its very own terms and conditions, which include a variety of restrictions and requirements. The most important is the wagering requirements, which sit at 2x the total bonus amount and deposit. Asides from this, customers will have to deal with the seven-day expiry time and maximum bonus winnings of £100. All requirements must be followed when attempting to claim deposit bonuses like this one here.

Bingo Street Promo Code

You can often find promo codes in the small print of bonuses and promotions. These promotional offers will require customers to input the promotional code to claim the available promotion.

Bingo Street requires customers to use the promo code ‘WHEEL’ when depositing to claim the Wheel of Spins promotion.

Free Bingo

Bingo Street currently offer no deposit free spins in a few of their promotions, one of which being their Daily Free Spins.

Wagering Requirements

Like most online bingo sites Bingo Street is not a bingo site with no wagering requirements. It does have wagering requirements, these vary on each promotion. For example, the welcome bonus’ wagering requirement is 2x the deposit amount and bonus funds.

Be sure to check out the Street bingo terms and conditions page to get to grips with all of the terms and conditions.

No Deposit Bingo

Whether you have never played bingo before or are an expert, you will want to see free no deposit bingo available to you as this is a great way to see what sort of games are on offer.

Unfortunately, Bingo Street is yet to explore this avenue, which is undoubtedly disappointing for its customers. However, check back with us as they may come to their senses in time.

Rating

All you could want in an online bingo site!

Bingo Street offers so many fun games to choose from.

Our Scores

BONUSES & PROMOTIONS 7.4*

DEPOSITS & WITHDRAWALS 7.1*

Ongoing Promotions & Offers

Once customers have their hands on the available sign-up bonus, they can set their eyes on the other promotions and street bingo offers to wait for them.

Aside from the welcome bonus, our next favourite promotion is the ‘Wheel of Wins’. The Wheel of Wins is full of rewarding Bingo Street bonuses ranging from bingo bonus bingo tickets and bonus funds to free spins. To qualify for this promotion, customers need to make deposits into their account, ranging from £10 to £100, and then you are free to spin the wheel. Customers should remember that each of the bingo bonuses available comes with its own wagering terms.

It is important to remember to use the promo code ‘Wheel’ when making each qualifying deposit to count towards the promotion. The higher deposit, the bigger the rewards.

If you are looking for more bingo sites with a Spin The Wheel, click here.

Mystery Jackpot Room – the mystery jackpot room is always looking for lucky players to claim the £500 jackpot prize for just 5p tickets. If you fancy winning this prize, then sign up today.

The Daily Unwind is a wagering jackpot to be won every 90 seconds at Bingo Street in the Daily Unwind competition room.

Daily Cashback – secure up to 3% cashback every day with Bingo Street of up to £100.

VIP Promotion & Player Rewards

Many sites offer VIP programmes or loyalty Programmes so their loyal players can make the most of their time and money spent across their site. Bingo Street is one of those sites, fortunately for you high-rollers.

The site will reward customers with one loyalty point for every 10p wagered across the Bingo Street platform. Customers can collect these loyalty points and exchange them for special treats that can be very rewarding. 15,000 points are up for grabs when customers refer a friend.

VIP programmes like the one available at Bingo Street are an excellent way for loyal customers to make the most of their hard-earned cash. Every penny they deposit and wager go towards their loyalty points, which can be exchanged for extra prizes. These additional prizes could be anything from free spins to free bingo tickets which will help them win more cash.

Bingo Street Review

As we said in the intro, Bingo Street wants to bring customers that sense of community they are used to or desperately seeking. Because of this, the Bingo Street platform is an excellent place to be.

The gentle orange, green, and blue colours on the site are welcoming and are not too harsh on the eyes when playing for long stints.

Bingo may be in the name of this platform, but it is certainly not the only focus across the site, with it packed full of game options. You will not be disappointed if you arrive at Bingo Street to enjoy traditional bingo games or some modern slots titles.

Bingo Games

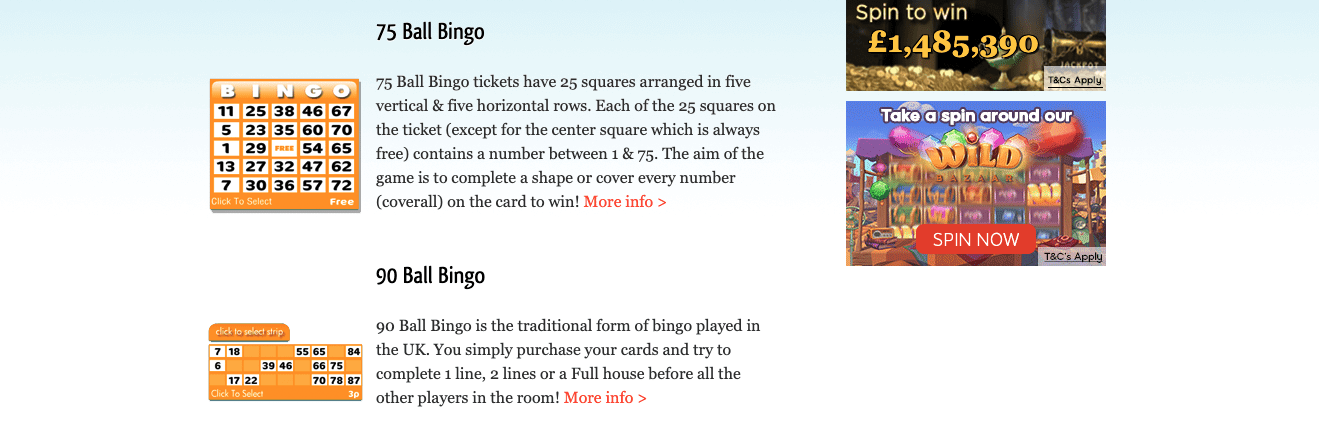

Since Bingo Street is primarily an online bingo site, they need to provide plenty of bingo options, and that is precisely what they do. Bingo games come in many forms, and Bingo Street does its best to cover all of these.

First and foremost, Bingo Street provides plenty of 90 ball bingo street bingo and 75 ball bingo games, considered the traditional bingo variants. But in this day and age, this is not enough. So, you can also find a bunch of 52-5 bingo games and 5 line bingo too.

Bingo Rooms

There are plenty of different rooms to enjoy across the online bingo and Bingo Street platform, which vary in several ways. Some rooms may offer different themes, while some vary in ticket price and prize money.

Alongside these rooms, jackpot rooms offer a considerably larger prize than the other options, including the Mystery Jackpot room.

Play on Mobile & Bingo Street App

The number of sites making their sites mobile-friendly is rapidly increasing, and it is the same story when making mobile apps. Bingo Street has gone down the mobile app route, and you will be able to down the app directly from the site itself. Under the “Mobile” section on the site, you will be given a QR code to download the app to get you playing mobile bingo right away!

However, this does not mean you cannot enjoy the Bingo Street platform without the app, as they are one of the many compatible sites with mobile devices. Mobile players will need to search for ‘Bingo Street’ on their mobile browser to find their platform. The good news is that Bingo Street runs on the HTML5 platform, which is incredibly smooth on mobile phones like iOS and Androids.

Slots & Casino Games

Many sites these days must offer more than one game type to stay competitive in the iGaming industry, and Bingo Street is an excellent example of this. Bingo may be the main focus of this site, but that does not mean you will not find an array of slots, progressive jackpots, and instant win games available.

Before you get ahead of yourself, the slots and progressive jackpot slots you find are not going to blow you away, but they will provide a nice break from their bingo games.

This is a Fluffy Favourites bingo site, some of the other slot games you can expect to find include titles; Aztec Rising, Piggy Payout and Irish Luck. As you will recognise from the titles, a few popular slots are available.

With many slots available across the Bingo Street site, it is only fitting that they offer some free spin offers for Uk players to claim and use on them. Head to their promotions page now to find all the available bonuses and offers, including free spins.

Payment Methods & Depositing

Having multiple accepted payment methods available to you is a must as a customer, and these banking options must be safe and secure. Once you are ready to add funds to your account balance, you will be pleased with the selection of options available to you. Fortunately, Bingo Street has several certified payment options that will keep all personal details safe, and you can find out more about them below.

As you can see, you have plenty of payment options available, which can be used for deposits and withdrawals. This platform has a deposit minimum value set at £5, and the minimum withdrawal amount also sits at £5. Withdrawal requests can take 3-5 days to process using debit cards.

First-time depositors should know that e-wallets like Neteller and Skrill may not be accepted as valid initial deposit methods when attempting to claim promotions like deposit bonuses. That is why we advise first-time depositors to use debit cards when making their 1st deposit, as this payment option is accepted when depositing on Bingo Street.

Bingo Street Sister Sites

Plenty of sister sites offer a similar platform to Bingo Street with their unique style. Below we have listed some of the sister sites available to you in the UK.

Who Owns The Site?

Bingo Street is owned and operated by Grand battery Holdings Ltd and has been since 2022. Grand Battery Holdings owns several gambling brands and companies, helping them build a strong reputation and find themselves based in Gibraltar.

Grand Battery’s success in the gambling industry has helped them grow their brand to massive levels and now offer many services.

Grand Battery Holdings have brought out many online bingo sites, including Wink Bingo, Posh Bingo, Tasty Bingo, and RedBus Bingo. With their hand in so many different sites, you can be sure to find many types of bingo available when dealing with them.

Licensing

Bingo Street is a well-licensed site thanks to being part of the Grand Battery Holdings group. Licenses with both UK Gambling Commission and the Gibraltar Gambling Commission.

So, customers at Bingo Street do not have to worry about their personal details’ safety or security, as certified licensing agencies regulate them.

Bingo Software

Like most Cassava Enterprises bingo sites and Grand Battery Holdings sites, Bingo Street runs on the popular Dragonfish gaming software. Being part of the Dragonfish Network may mean that Bingo Street offers very similar or even identical games to many other sites.

However, we also know that Dragonfish software is of excellent quality, so you can expect to come across smooth gameplay and graphics when enjoying Bingo Street games.

Support Details

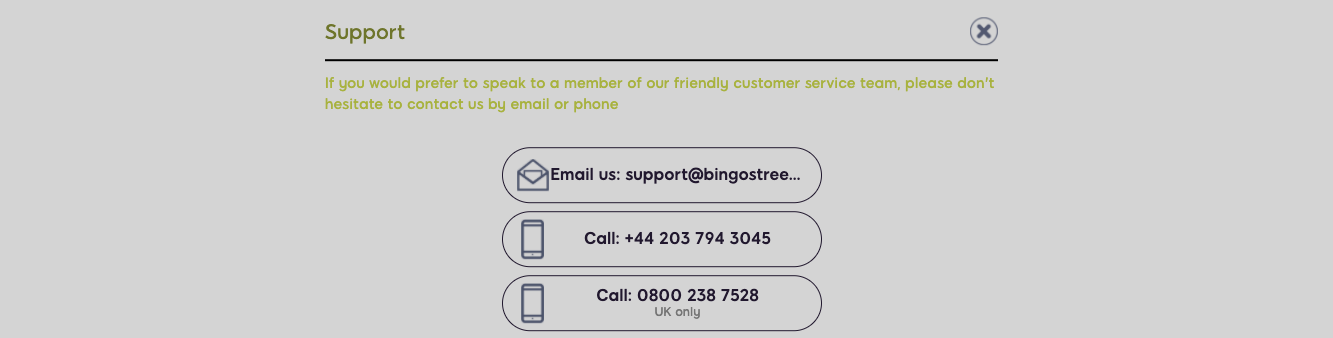

Bingo Street offers all the usual and expected customer support avenues to ensure their customers are never without help when it’s most needed.

The first port of call for any Bingo Street customer is to use the available live chat service. Live chat will allow customers to quickly contact a customer service member who will provide quick solutions.

A helpful FAQ page is also available to Bingo Street customers, a great place to find answers to frequently asked questions.

Customers can use the toll-free telephone number – 0800 279 6213 – between 10 am and 2 am.

Final Thoughts

Bingostreet has many plus sides, which is why we recommend you try it out if you have not already done so.

Bingo Street is full of a wide range of bingo games, from classic ball games like 75 and 90 to more modern games, including bingo roulette and five-line bingo. However, Bingo Street can do much more than being a platform filled with bingo games, as they offer many slots. This is not all, as the Bingo Street game portfolio offers jackpot bingo games, jackpot games, and table games. The range of games does not end here with customers having access to chat games. With such a large selection of games available, it should be a no-brainer for you to give this bingo platform a chance.

Customers can access various chat rooms to engage in light-hearted chat with other players and hosts.

If the game variety of this platform is not enough to tempt you, maybe their selection of promotions and offers is. As a Bingo Street customer, you will have access to a range of rewarding bonuses. These may include free bingo tickets, bonus funds, cash prizes and other lucrative bingo bonuses. If you fancy getting your hands on your bingo tickets, then see what terms and conditions apply before making your min deposit.