Lucky VIP is an uncluttered casino site that is easy on the eye, and it combines ease of use with user-friendly simplicity. Please read our review below to see how lucky you could be at this excellent casino site.

Lucky VIP is an uncluttered casino site that is easy on the eye, and it combines ease of use with user-friendly simplicity. Please read our review below to see how lucky you could be at this excellent casino site.

Lucky VIP Casino offers a vast array of games, including slots and online casino games. Before jumping straight into a game, you may want to check it has all the features and functionality you are looking for.

The UK casino site’s design is video-game Esq with animated characters featured on the home page against the backdrop of what looks to be an ancient city. The intuitive layout has been well designed to allow the player to navigate the site easily.

The site was launched in 2016 with the primary goal to provide all players with a VIP casino experience without the VIP price tag.

[toc]

To claim the Lucky VIP welcome offer and bonus, you will first need an account. You can do this by clicking ‘JOIN NOW’ on the Home page. Required registration details include personal, contact and account information.

As a new player, the method for registering is pretty straightforward with a three-step process;

The Lucky VIP login is straightforward to navigate, and the process to claim the bonus is clearly outlined. The welcome offer advertised on the home page is a 100% match deposit casino bonus for each player that deposits £20.

Lucky VIP Casino doesn’t have a UK no deposit free spins offer available currently, but we’ll keep checking and update you if they add one to their site. The site has many other things to get excited about and make your money go further, so please read on.

| 🔴 Site Name | Lucky VIP |

| 💋 Owner | Daub Alderney Limited |

| 📊 Markets | Casino, Slots |

| 😘 Welcome Offer | Up To £555 Welcome Bonus |

| 💯 Bonus Percent | 100% |

| 💳 Minimum Deposit | £10 |

| 🔥 License | View |

| 📅 Founded | 2016 |

| 🏪 Software | IGT Casinos UK Microgaming Casinos UK NetEnt Casinos UK Novomatic Casinos |

| 📪 Address | Suite I

Turing House |

| 🔗 Website | luckyvip.com |

| ☎ Phone Number | 0800 901 2512 |

support@luckyvip.com |

|

| 😍 Sister Sites | Regal Wins, Aspers Casino, Lucky Pants Bingo |

| 💰 Deposit Methods | Maestro, MasterCard, PayPal |

The welcome bonus is advertised at £20, and this is based on a minimum deposit amount. If you’re feeling lucky and want to deposit more, the welcome bonus offer of 100% is available of up to £50.

So if you deposit between £20 and £50, the site will match your money, but if you deposit £100, you will still only get £50 as this is where it caps out.

There are few casino bonuses that are more lucrative than no deposit casino bonuses. That is because, as you have probably worked out, it doesn’t cost you anything. Unfortunately, there are aren’t any no deposit bonuses featured at Lucky VIP at the time of writing.

Lucky VIP provides a transparent and achievable welcome offer.

The bonus is available to all players who sign up successfully and are validated by Lucky VIP Casino. It is only valid on the first deposit, which must be of a value over £20 and is limited to a deposit of £50, meaning the maximum bonus a player will receive is £50 as per the table below. Real funds will be used first, and then the bonus funds will become available.

And you need to be sure to spend the balance within 7 days, or it will expire! You can check out the full terms and conditions at the Lucky VIP Casino page.

| 1st Deposit | Your Bonus | Balance |

| £20 | £20 | £40 |

| £30 | £30 | £60 |

| £50 | £50 | £100 |

Lucky VIP Casino updates its casino bonuses every season, so it’s a site worth bookmarking and keeping enough funds in your account to ensure you don’t miss out. This site looks after its loyal players from the initial welcome bonus to the free spin rewards with further deposits.

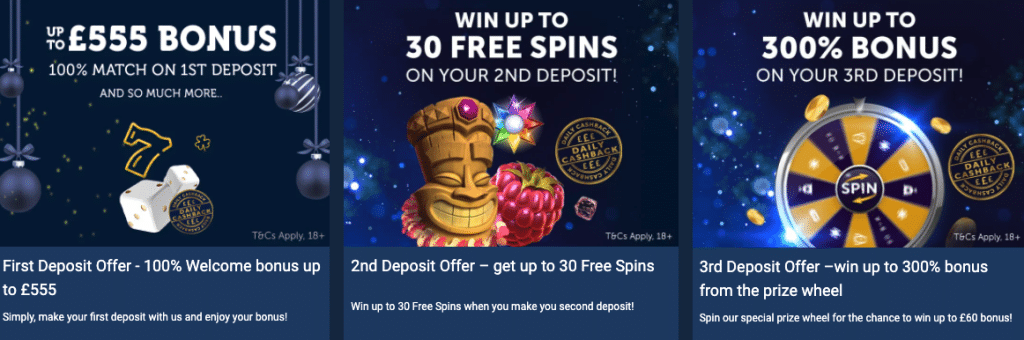

Several promotions are available on the various games offered on the Lucky VIP Casino site; if slots games are your thing, you get up to 30 free spins on your second deposit.

Lucky VIP casino goes even further for its players, offering a 300% deposit casino bonus on your third deposit. This is based on a one prize wheel spin and can pay out as much as £60 in bonus money. It also advertises daily cashback of £50 on your deposit losses. This is payable on a minimum deposit of £10, so this game really does cater for players with deposits with anything from small to large amounts.

Lucky VIP is exceptionally generous with its offers and promotions, specifically targeting new players, compared to other online casino sites.

There are no offers or promotions available for existing or returning players on this site, as with some others. Still, Lucky VIP changes its offers seasonally, so there’s nothing to say they won’t be available throughout the year.

Lucky VIP Casino may sound off-putting to those with smaller deposits and lead you to assume you need to spend a tonne of money to become a ‘VIP’ to play. But do not fret – this is 100% not the case, and the good news is anyone can be a VIP! The VIP points feature means every time you take a spin it can lead to some exciting loyalty rewards. The primary purpose of Lucky VIP Casino is to create a VIP experience for everyone. So if you want that champagne experience with a lemonade budget, this is the site for you.

To start earning VIP points simply sign up. This is a £10 deposit casino site. The emphasis of this site is to provide a good service and a variety of games for a variety of player experiences and budgets.

Points can be converted into cash for an exchange rate of approximately 1000 points to £1. Any points are subject to a wagering requirement of 10 times the value.

There is no VIP programme other than that as outlined above despite the name.

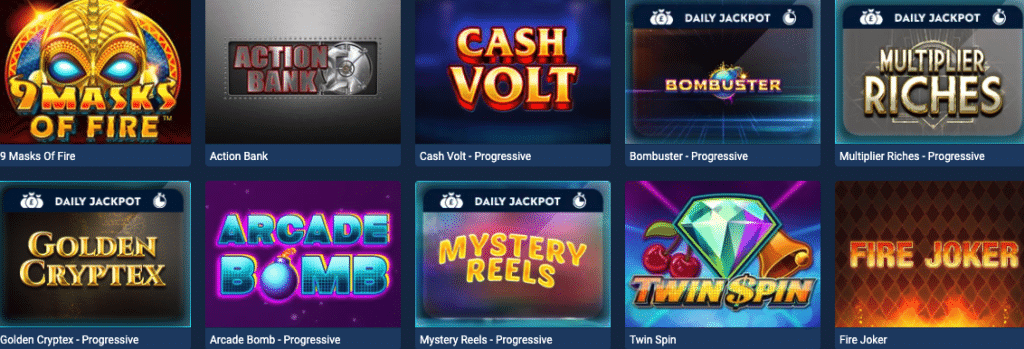

At Lucky VIP, there are 16 progressive Jackpot slots. They appear in the category of Mega Jackpots, and these are typically known to be highly volatile and high-value games. Top prizes have exceeded seven figures, and some Daub Alderney brands display winnings of over £3 million. That said, over the last five years since 2016, there doesn’t seem to have been any reported winners taking home these kinds of figures. But for those looking for a place to play high-risk/ high reward, Mega Jackpots is where you want to head.

Mobile compatibility is of the utmost importance for any online casino gaming brand in this day and age, and Lucky VIP has clearly taken this into account.

Whilst there isn’t a dedicated mobile Lucky VIP app, you can still play your favourite games anytime, anywhere on the top mobile casino site. The site worked on PC, mobile phone and tablet device, and both ios and android software are fully supported. All you need is a web browser and an internet connection. Thanks to the instant play software you don’t have to download anything just login and away you go!

From both an iPhone and android device, the site is as user friendly as it is on a PC. It has details of the welcome bonus offer, and quick links to players favourite online casino games such as Fishin Frenzy and Rainbow Riches. It also highlights what new games are available if you’re looking for a quick link to something new and exciting. If you’re looking for Live Casino, then this is also easy to find from the home page using mobile.

Mobile users login by entering the username and password from their device.

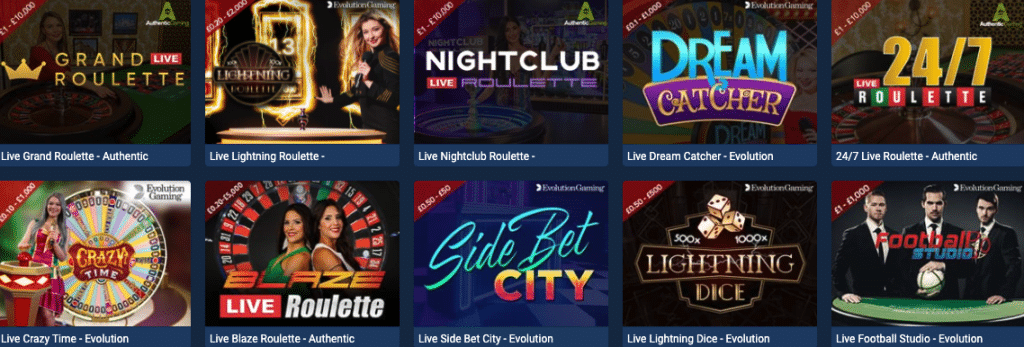

One of the options featured on the homepage is ‘Live Casino’, which features a live, interactive dealer. Lucky VIP has a choice of 20 live casino games, including Roulette, Blackjack, Baccarat and Poker, all available as live games from casino software provider NETENT, an industry leader in online live casinos.

The most popular live game is roulette, both on and offline casinos and on the live platform. The Lucky VIP live casino provides eight variations of roulette, including US and European versions. Players looking for live games can also play one of twelve blackjack games.

Live games on this site get positive feedback on presentation with an overall feeling of glamour and a VIP experience. The dealers tend to be female using the English language.

Lucky VIP casino offers up to 30 free spins with a second deposit. It features games including Shamrock Holmes Megaways and Western Belles, which advertise free spin features.

Lucky VIP prides itself on it’s large selection, with slots games developed by the biggest casino software providers including IGT, NetENT, Realistic Games, Microgaming and Play’n Go. Some of the other slots games features on this site include Siberian Storm and Magic Castle.

The range of around 400 online slots includes popular new games and some older fan favourites.

If roulette and blackjack sites are more your thing, you’ll be interested in knowing that there are around 40 table games on the site. These include a number of versions of Craps, Baccarat, Blackjack, Three Card Poker and Ultimate Texas Hold’EM.

Table limits are clearly shown on each game graphic.

All the following can be used for both deposit and withdrawal. The minimum amount is £10 for all (except Paypal, which is £20). We recommend using PayPal for fast casino withdrawals if you want your money quickly.

Lucky VIP Casino sister sites include bingo sites, slot sites and online casinos. A few notable mentions are Spin and Win, Moon Games and Kitty Bingo.

The sites FAQ’s answer most of the commonly asked questions but unfortunately if you speak anything other than English you will need to translate. However, the FAQ’s are a great place to start if you gave a query. This site offers more support options than many of its competitors; 24/7 support via Live Chat, email or telephone under normal conditions. However, due to the ongoing pandemic, they have had to revise their support hours slightly and are now available between 3 am and midnight for Live Chat and phone, seven days a week.

Players can email at any time but may have to wait slightly longer for a response right now. There are two email addresses available; support@luckyvip.com for all support related queries and promotions@luckyvip.com, more for promotion associated questions.

The freephone number to call is 0800 901 2512.

Lucky VIP can deal with queries from any country but unfortunately only have English-speaking agents.

We tested out the Live Chat and it was, as advertised, an immediate response with a live agent (not a bot!)—top points for support.

The quality of games and level of customer service is rated highly against the site’s competitors.

The use of themes and titles makes it an easy site to navigate, with the overall lobby and specific lobbies having a well-presented view of the games available.

Lucky VIP Casino online is brought to you by Daub Alderney Limited. This organisation owns more than 10 different gambling sites across the United Kingdom and Europe.

Lucky VIP Casino has been in operation for five years and is licenced and regulated in Great Britain by the Gambling Commission. It is also licenced and regulated by the Alderney Gambling Control Commission to offer Gambling facilities in jurisdictions outside of Great Britain. Both are highly respected in online gambling, making them an honest and trustworthy casino site.

Lucky VIP Casino is a great place for anybody who enjoys anything from table games to live casino and slots games. There really is something for everyone. Casino bonuses and promotions are available for new players to get the most from their money. And update seasonally, which may lead to include existing/ returning player offers.

The site itself is nice to look at, easy to use and would appeal to anyone with an appetite for online gambling. The wagering requirements are realistic for most people and the brand itself has been well established.

The slight negative of no specific downloadable app is offset by the friendly user experience across all devices. And the responsible gambling features in place are wide and varied in order to support anybody who is struggling and remind players to stop if the game is no longer fun.

Overall a feature-rich gaming site with a transparent and achievable welcome offer, provided by a well known and trusted authority in this niche.

UK facing gaming sites do not allow credit card deposits, this is not unique to Lucky VIP Casino. This prevents players from being able to rack up a considerable amount of debt. But alternative methods available on this site including debit cards and safe prepaid cards, bank transfers and e-wallets. There are no charge for deposits and they appear instantly in your gaming account. Withdrawals, however, can be subject to the usual delay and some providers apply a fee.

The Lucky VIP games appeal to those who only want to stake small and those who prefer to bet big. Some roulette games have a spin value of £0.10, increasing to £100 per spin. This operator caters to a range of betting limits and a wide variety of budgets.

This operator offers responsible gaming measures, including breaks, self-exclusion and deposit limits. There are also banners adverts within the site containing links to organisations who can provide gambling support for players who might feel they need it.

The site links to some excellent resources, namely BeGambleAware, GamStop and GamCare.

The RTP is a key feature to review when looking at online casino games, and it measures how much of the share of stake the player receives. The average for the industry is around 95 to 97% which is usually where Daub Alderney Limited games sit, this one included.