Pots of Luck Casino Site brings the luck of the Irish to the online gaming community with its Irish influence.

Pots of Luck Casino Site brings the luck of the Irish to the online gaming community with its Irish influence.

Pots of Luck is a top casino site with a clear Gaelic theme; there are plenty of slots to choose from and some excellent ongoing promotions. The casino at Pots of Luck even has a smattering of table games.

There is something for everyone at Pots of Luck, and a casino player would have no trouble finding something to play.

[toc]

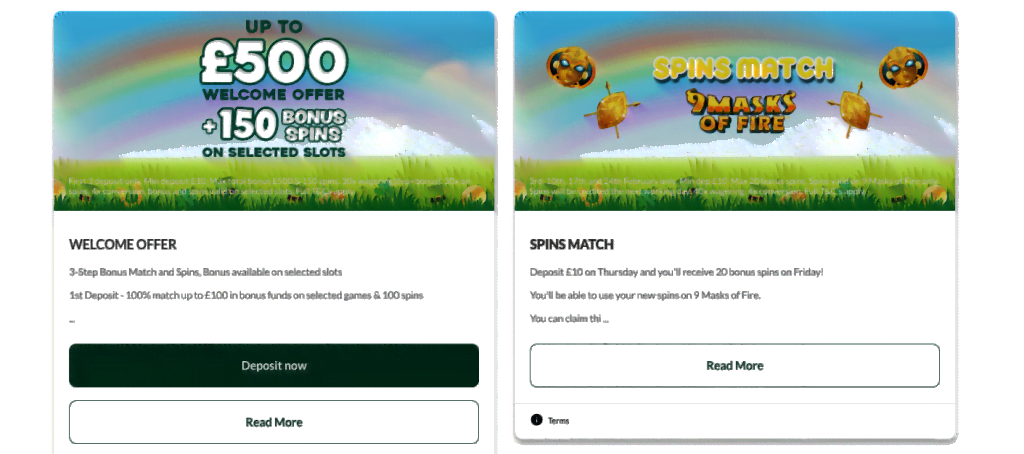

Pots of Luck’s mascot, Seamus, wants to offer players a welcome bonus to set players up on the right path.

Pots of Luck seem to know that some players may prefer slots to bingo and vice versa, so they have two sections of the site, a bingo section and a casino section and, because of this, have two different welcome offers.

The first offer lets players receive up to 300 free spins with their first deposit.

The minimum deposit is £10 and is available to new players on their first deposit only. The minimum number of spins for the offer is 100, and the maximum is 300.

Not only that, but players also choose which slot game they wish to play, with the choice being in between Starburst slot, Finn and the Swirly Spin slot or Finn’s Golden Tavern slot.

Pots of Luck will credit the free spins to your account within three working days, and any winnings from the free spins Pots of Luck will grant as bonus funds.

Their second offer can be found in the bingo section and allows players to deposit £10 to receive £30 in bingo bonus funds, 50 free spins on Starburst and one week of access to their free bingo room!

The minimum deposit for this offer is also £10, and the maximum bingo bonus and no deposit free spins available is £30 and 50, respectively.

The free bingo room becomes available once the player has wagered £1 on bingo. The free bingo will be available in the Newbie Room, open daily between 12 pm – 1 pm And 3 pm – 4 pm.

The bingo bonus funds will be available for 28 days after being credited. To receive the free spins, the player must open Starburst.

Unfortunately, players have to choose between both offers, so make sure to choose wisely!

Full terms and conditions apply to both offers; Pots of Luck recommend reading these before playing.

| 🔴 Site Name | Pots of Luck Casino |

| 💋 Owner | ProgressPlay Limited |

| 📊 Markets | Casino, Slots |

| 😘 Welcome Offer | 50 Free Spins No Wagering |

| 💳 Minimum Deposit | £20 |

| 🔥 License | View |

| 📅 Founded | 2016 |

| 🏪 Software | Evolution Gaming Casinos IGT Casinos UK Microgaming Casinos UK NetEnt Casinos UK |

| 📪 Address | Kolonakiou 26 |

| 🔗 Website | https://games.potsofluck.com/ |

| ☎ Phone Number | 0161 8705948 |

customersupport@thegracemedia.com |

|

| 😍 Sister Sites | Fruity Vegas, Bonzo Spins, Monster Casino |

| 💰 Deposit Methods | Paypal, Neteller |

There are always offers on the go where players can get their hands on free spins. Make sure to make full use of the slots welcome offer, where you can get up to 300 free spins depending on your deposit.

If you want to use the welcome bingo offer instead, there are 50 free spins on Starburst to use!

Wagering requirements apply to most promotions at ports of luck, and the welcome bonuses are no exception.

Wagering requirements for wins from the free spins are 30x, and the conversion is 4x the bonus amount awarded.

These wagering requirements refer to the free spins from either welcome bonus.

Regarding the bingo bonus, wagering requirements are 5x the bonus amount. Pots of Luck will cap the conversion to cash at 4x the bonus amount.

All ongoing casino bonuses and attributed winnings will void if a player wishes to withdraw funds before the wagering is complete.

Whilst wagering requirements are generally similar across the board to the above, these can change, and we recommend checking before playing.

Pots of Luck Casino always have some promotions with bonus features on the go.

To find out what is available at any time, head to “all promotions”. Here you will find promotions for both the casino and bingo section, so make sure to check out both.

There is always plenty up for grabs, such as free spins, casino bonuses, free bingo and more.

Pots of Luck also contact players with fantastic offers to take advantage of, so make sure your contact information is correct when signing up. You can update your contact information on your profile if you need to.

You can also change your contact method, I.e. phone, text, email or post. Or you can opt-out of receiving correspondence, not just from Pots of Luck but from they are trusted third parties also.

Pots of Luck offer an exclusive VIP which you can only join if you receive an account upgrade email. If you receive the email, you can join the VIP club, giving access to priority customer services, weekly bonuses, enhanced VIP promotions, and VIP anniversary bonuses!

Players get the chance to move up four tiers, Silver, Gold, VIP Premier and VIP Elite, gaining access to more benefits the higher they get. Once at the top tier, they will get a personal account manager, a birthday bonus and VIP hospitality.

The more you play at Pots of Luck, the more likely you will get that special email and the extra benefits of the VIP Club.

Like most online gaming sites, Pots of Luck has some promotions requiring a promo code and others that do not.

The welcome offer for free spins does not require a promo code, whilst the welcome offer for the bingo bonus and free spins on Starburst does.

To avoid being caught out, our recommendation is to double-check for a promo code before taking advantage of any promotion or offer.

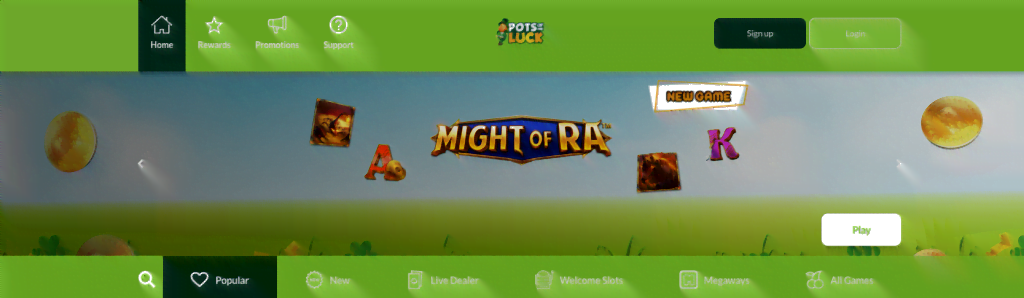

With a name like Pots of Luck and a mascot called Seamus, it should come as no surprise to learn that Pots of Luck has an Irish theme.

Seamus the Leprechaun features heavily throughout the site, and horseshoes and four-leaf clovers dot across the pages. Scroll down to find the casino news listed.

Green is the central colour theme, but it doesn’t overpower.

The new online casino site is easy to navigate. On signing in, many features and tabs can take you to All Promotions, Players Favourites, Welcome Slots, Bingo, New Games, Irish Games, My Favourites, and All Games. There is also a search function allowing you to search for a game if you know the name or want to find something special, such as scratch cards or roulette.

Players are always aware of how much they have to play with, as their cash balance and bonus balance are shown at the top of the screen. Right next to this is the deposit button and the user’s account.

It is worth taking the time to have a quick mooch about once signed up to get a feel about where everything is so you don’t miss out on anything.

Pots of Luck offers great bingo games options: 90 ball, 80 ball and 75 ball bingo.

There are only six bingo rooms available at Pots of Luck:

The chat feature allows players to interact with each other.

Bingo is not the priority at Pots of Luck Casino, so there are few rooms here. However, the games are great, and it’s worth checking them out.

The free newbie room is available on sign-up and a minimum first deposit of £10. It becomes available for one week after players have wagered a minimum of £1 on bingo only.

The welcome bingo offer also allows players to get a 300% bingo bonus on the first deposit to play with, and there are always ongoing offers for users to play to get free bingo.

Pots of Luck is a web-based user interface, so there is no app for iOS or Android devices to download. Just use the top mobile casino site to navigate the site and sign in, and Pots of Luck works excellent as a mobile casino.

The gameplay on the mobile site is good. Unfortunately, not all games are available to play on the mobile site, but there is still plenty available.

Slots fans are spoiled for choice here. There are loads of types of slots games, including seasonal slots.

All the favourite slot action can be found here, including Fluffy Favourites, Finn’s Golden Tavern, Starburst and Fishin’ Frenzy. There is also a section just for Irish Games with Rainbow Riches, 9 Pots of Gold, Rainbow Jackpots, Kiss Me Clover and Many More.

As well as slots, there is a fab mix of casino table games.

Some roulette games are available, including Lightning Roulette, VIP Roulette Live, Auto Roulette VIP, and French Roulette Gold.

Some of the best online blackjack games include Blackjack Classic, Speed VIP Blackjack Live, Blackjack Silver and Blackjack White.

There are only two poker games available, Caribbean Stud Poker and Three Card Poker.

Baccarat Games include Baccarat Control Squeeze, Baccarat Squeeze, Baccarat Live, and Speed Baccarat Live.

Pots of Luck Casino has partnered with some great casino software providers, including Blueprint Gaming, Netent, Microgaming, Evolution Gaming, Nektan, Eyecon, IGT, and Nextgen Gaming software.

These partnerships allow Pots of Luck to provide players with a wide range of games.

Pots of Luck offers great online scratch cards, including Fabulous Fairies, Book of Amduat, Arriba, Gold Saloon Superpot and Swanhouse.

Pots of Luck Casino has a great selection of casino payment options, including PayPal, Skrill, Neteller, Paysafecard, EcoPayz, Debit Card (including Mastercard and Visa), Giropayz, Sofort, Trustly, Maestro, Boku, Skrill 1-Tap, Instant Banking, and MuchBetter. Players in the UK cannot use a credit card to make a deposit.

With every payment method except Boku, the minimum deposit is £10, and Pots of Luck do not apply a transaction fee. If using Boku, the minimum deposit is £10, and a 15% transaction fee applies.

To deposit, click on the Deposit button at the top of the page and follow the instructions.

Withdrawal restrictions apply, and players may only use Neteller, Skrill, Paysafecard, MasterCard, Visa, Trustly, Maestro, Skrill 1-Tap and MuchBetter to withdraw. The minimum withdrawal is £10. Pots of Luck offer fast casino withdrawals and may take up to 3 working days to process withdrawals, and transactions may take an additional 3-5 working days to clear with the provider.

A £1.50 process fee also applies to all deposits under £30, so it makes sense to hold off withdrawing until you have more than £30 available.

In some cases, Pots of Luck may request identity documentation from a player before processing a withdrawal. If they ask this, make sure to provide it as soon as possible to avoid delays.

Pots of Luck has some great sister sites, including Fruity Vegas, Bonzo Spins, Golden Ace, Sweet Wins, Monster Casino and Black Spins.

Pots of Luck is owned by Necktan (Gibraltar) Ltd. Launched in 2009, Nektan Limited has continued to grow exponentially and manage over 100 online casinos.

Pots of Lucks is part of the Scorching Affiliates Program. For more information, head to https://www.scorchingaffiliates.com/.

The site is operated by ProgressPlay Limited, registered and licensed by the Gambling Commission in the United Kingdom and regulated by the Gibraltar Gambling Commission under the Gambling Act 2005.

Pots of Luck has partnered with Pragmatic Play to provide a selection of bingo rooms to keep players entertained.

There are several options to contact Pots of Luck’s customer service team:

They advise that their customer support agents will be available on their live chat and telephone between 8 am and 12 am, but we found that was not the case when we used their live chat function during those hours. Instead, Pots of Luck provided an email option. However, they were still very fast to reply to our email, and their customer service team responded in less than an hour.

There is also a Frequently Asked Questions section covering many areas, so it is worth checking this for any query you might have.

Pots of Luck supports responsible gambling and offers various tools to help players gamble responsibly.

They also point out that you can call or email their customer support team if you want to:

Players will have the luck of the Irish at Pots of Luck. With a great choice of slots and table games, Pots of Luck also make a token gesture with a few bingo rooms to try.

Whilst it’s a shame that players have to choose between 2 welcome bonuses, it’s great that there are two bonuses to choose from depending on what a player wants!