Daily Record Bingo is another excellent release from Reach Gaming. It was under the Cashcade Network formally, which was also powered by Dragonfish. The provider then moved it to Jumpman Gaming together with its sister sites like Mirror Bingo.

Daily Record Bingo is another excellent release from Reach Gaming. It was under the Cashcade Network formally, which was also powered by Dragonfish. The provider then moved it to Jumpman Gaming together with its sister sites like Mirror Bingo.

Currently, this is a brand new UK bingo site for 2021, all thanks to Jumpman Gaming, who made everything run smoothly. Daily Record Bingo is similar to Mirror Bingo in every area. If you have played a game at Mirror Bingo, then you know exactly what to expect on Daily Record Bingo.

It might be a deal-breaker if you’re looking for a new experience. However, there is always something extra that you can enjoy as a new member. You can make new friends in the Bingo rooms and enjoy different themes and graphics.

Daily Record Bingo offers a friendly community to be a part of. Once you sign up for an account, you’ll be given 20 no deposit spins that you can use to make your first win.

In terms of the design and theme, the site looks great. The site is mobile-friendly, and you don’t need to download any software to play a wide variety of games from the palm of your hands.

Daily Record Bingo takes pride in its Bingo rooms, and free spins offer. This is what keeps most players coming back to the site again and again.

[toc]

Want to start your day right? Open your Daily Record Bingo account today and get 20 free spins to play some games. The best thing is that you don’t need to deposit to get the spins.

However, the free spins come with the condition that you can only play with them on the Starburst slot. To get the spins, you need to register an account, verify your info, and add your debit card info.

Exhausting your free spins isn’t the end of the fun. Once you make your first deposit as a newbie, you’ll be given free spins. Their welcome deposit bonus is that you play with on the mega wheels. But, you must deposit at least £10.

Spinning the wheel guarantees you goodies like Amazon vouchers and free spins offers. You can play the free spins on popular sites like Fluffy Favorites, Starburst, and Irish Luck. The highest reward is 500 Free spins.

For more information check out our page Fluffy Favorites bingo.

If this sounds like the perfect welcome offer for you be sure to open an account with Daily Bingo today. The link above will take you to the Daily Record Bingo login page.

As a new player at Daily Record Bingo, you don’t need a promo code to activate any available bonus offers. In short, this site has never used any promo or bonus codes before, and it hasn’t expressed any intentions of imposing one on the players any time soon.

Ensure that you’re constantly checking your inbox. They always update you on special bonus offers, competitions, and promotions. Don’t miss out on any of these.

Once you open an account on the Daily Record Bingo site, you automatically qualify for 20 free spins. You can only use the spins on Starburst. You must add your debit card details and verify them to claim this offer, and you don’t need to deposit to get them.

| 🔴 Site Name | Daily Record Bingo |

| 💋 Owner | Jumpman Gaming |

| 😘 Welcome Offer | Win Up To £6000 |

| 💳 Minimum Deposit | £10 |

| 🔥 License | View |

| 📅 Founded | 2021 |

| 🏪 Software | Jumpman Gaming |

| 📪 Address | Inchalla Le Val Alderney GY9 3UL |

| 🔗 Website | dailyrecordbingo.com |

support@dailyrecordbingo.com |

|

| 😍 Sister Sites | |

| 💰 Deposit Methods | Debit cards, PayPal, Paysafecard |

Like any other gaming site, Daily Record Bingo has some rules governing the site. The wagering requirements are primarily associated with the deposit and registration bonus. The main requirement with the no-deposit bonus is to verify your debit card information. The maximum cash you can withdraw is £50, and it wagers at 65x.

The first deposit bonus that you can only play on the Mega reels allows you to withdraw to a maximum of £250. However, this solely depends on all the subsequent deposits, and the wagering requirement for this bonus is 65x. See our recommended low wagering bingo sites to see our expert picks.

Upon account registration at Dailyrecord Bingo, you’ll receive 20 free spins. You don’t need to deposit to get these spins. But you can only play on Starburst using these spins. And your first deposit of more than £10. gives you a spin on a mega wheel. If you spin accurately, you might win up to 500 free spins that you can play on Fluffy Favourites. You must follow all the terms and conditions of the site.

You can play no deposit Bingo games from providers like Microgaming. And, NetEnt, Pragmatic Play, Scientific Games, Playtech, Eyecons, and others. You can do it from your desktop, mobile, and tablet wherever you’re. Just register an account today and have unlimited fun.

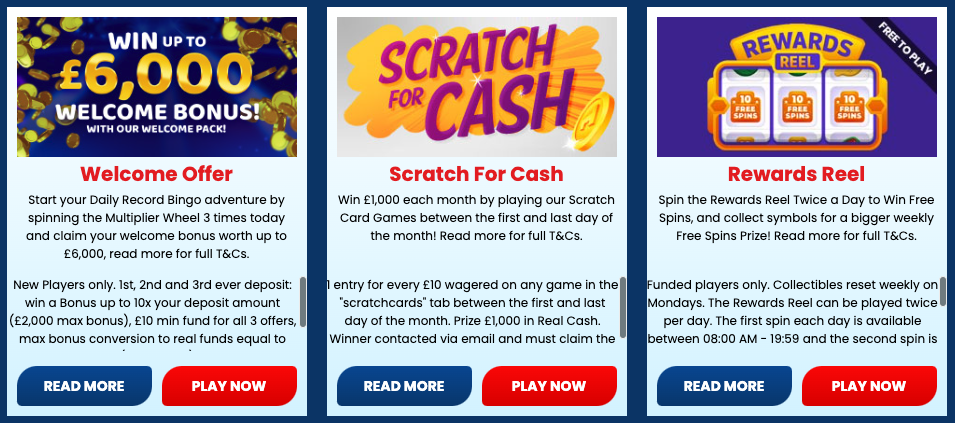

Apart from the welcome bingo bonus, there are many other ongoing promotions and special offers. They aim at both new and old players on the site. But, before you go ahead to grab any of those, make sure you verify your details as it plays a significant role. The promotions include:

This promotion runs every month. It allows any player to grab free spins if you make a minimum deposit of £20.

Is today your birthday? Or coming soon? Take advantage of that and grab some free spins on your special day. All you need to do is log in to your Daily Record Bingo on your birthday and grab your treat.

Are you one of the few players who roll high? Deposit a minimum of £100 and get free spins to spin the mega Turbo wheel. The reward ranges between 50 and 500 free spins.

As much as you’d wish to be a winner every day, that’s not the case. Sometimes we win, and some days we lose. And that’s the beauty of gaming—however, thanks to Daily Record cashback promotion. For every coin you lose, you’ll be given a 5% cashback when you log in the following day.

What are you usually doing on Wednesdays between 3 pm and 7 Pm? Play a game at Daily Record for a chance to win 500 free spins. These spins can only be played on slot games.

Once you become a member at Bingo Daily, you stand a chance to be a VIP. Besides the welcome bonus and the incredible exclusive offers, you’ll be collecting trophies daily.

As you continue playing on the site daily, you’ll be unlocking various achievements. This progress will take you through different levels and lead you to unlock new spins on the Turbo Wheel or Mega Wheel.

Check out more spin the wheel bingo sites here.

Daily Record Bingo VIP club is not any different from its sister sites. They have five levels: Member, Bronze, Silver, Gold, and Black.

Each level comes with goodies like extra spins, cash backs, birthday gifts, and others. Despite the level that you’re in, you’re regarded as a VIP at Daily Record Bingo.

Daily Record Bingo is an extension of other Jumpman Gaming sites. The site is well known for its instant gameplays. Their Jackpots, actual casino games like Live Dealer Division, Roulette, and Blackjack, are the best. The promotions are also very captivating.

If you want to join as a new member, you’ll have to meet specific standards. This ensures that you get to experience all the good things going on in the 75, 80, and 90-ball lobbies.

At Daily Record Bingo, as a member, you’re eligible to claim free bonus spins, which are all players favourites. You even get them without making a single deposit. How sweet is that?

If you make a deposit, you’ll have a chance to play your spins on Mega Wheel and get a maximum of 500 extra free bonus spins. You can play with these spins on the conventional game of your choice.

Do you already have an account? On the site’s homepage, click the Bingo tab. You’ll be taken to the games section, where you can play various exciting bingo games in different rooms.

You can play the two classic bingo games like 90-ball and 75-ball.

They also have a third one, an 80-ball bingo game not primarily available on other sites. You can access the games at any time of the day.

There are also more specials that you can play the entire day. This includes Number Bingo, Deal or No Deal Bingo, and many others. Daily Record Bingo has a precise schedule, and the site always lets you know the games running currently and what’s up next. They also include the prizes you can win and the tickets you need.

If you’re expecting all things Bingo from Daily Record Bingo, you’ll be in for a surprise. They have other options like side games, slots, and casino games, and it’s a great way to break from bingo games and refresh your mind.

Daily Record Bingo also has a new section that will help you keep up with new products on the site. Playing your favourite Bingo games at any time from anywhere is every player’s checklist tick. So all Bingo sites try to measure up. You can play Daily Record Bingo from most mobile devices, and you don’t need any software download.

Daily Record Bingo comes with various rooms that players can enjoy being part of. You can access the rooms at any time. Every room has its own schedule, but there is always a room available for you.

The available rooms include 90-ball, 80-ball, and 75-ball bingo rooms. You can access chat options and access to mini-games in these rooms.

The main rooms offer Country Road, Jackpots, Boombox, Heavyweight, Bingo Blast, Friday fun, and more.

Most of the exciting Bingo games in room 90-ball games are instant plays, and you can play and win with a million versions. If you’re a mirror Bingo player, currently, there are no rooms dedicated for this.

Want to play a wide variety of games while on the road or from your bed? You can quickly achieve this with the Dailyrecord Bingo Mobile optimized version. The mobile gameplay is in-browser, and you don’t need to download any software to access it.

The design of the site is straightforward yet classy. You can quickly figure out your way around the website. Start your journey from the menu button at your top right corner—the mobile version of Daily Record Bingo loads smoothly and without a hitch. If you’re used to encountering troubles on other sites, there is nothing like that at Daily Record Bingo. Everything is flawless and seamless at this online mobile bingo site.

As much as the site is a favourite Daily bingo destination among the online bingo sites, bingo games are not the only focus. They offer amazing slots and casino games as well. The site has over 100 titles of Daily Record Slots for you to enjoy. They are powered by the best providers in the gaming industry like Eyecon, Microgaming, NetEnt, and many more.

The recent releases include Electric avenue, Tower of London, Lady Earth, Arthur’s Fortune, Atlantis, Aztec Spins, Reactive Mega Drop, and Zeus III. All these favourite games are usually accompanied by a collection of progressive jackpots and Daily Drop Slots. You need the search bar to identify Slingo sites or Megaways titles to find your online games easily.

Daily Record slots game software is from Jumpman. Do you prefer great classic games of 80-ball? Or like the variants 75-ball, or 80-ball games, there is always something for everyone on this site.

Most of the games from this Jumpman include jackpot games with rewards of up to a million. It is the same case with the Mega Bingo Millions.

Daily Record Bingo has a variety of online scratch cards to choose from, including Big Scratchy and Happy Scratch, to name a few.

The minimum deposit you can make at Daily Record Casino is £10. You can fund your account using various methods for example Paypal bingo sites and many more such as Maestro, Paysafecard, Mastercard, and Valid Debit Card.

You can also fund your account balance from your mobile device pay-as-you-go (PAYG) balance. Depositing from your mobile device will incur a charge fee of up to £2.50, and this will cut across all withdrawals. The withdrawal request takes a maximum of 72 hours to be accepted, and it then takes a maximum of 5 days to reflect on your account balance.

Daily Record Bingo will ask you to verify your payment info before approving your withdrawal request. This is for security and safety purposes. They usually want to see your photo ID, like a driving license or an up-to-date utility bill.

Providing such info might be a turn-off to some players. But, it is necessary as it’s a requirement from the United Kingdom Gambling Commission, and they do this to prevent money fraud.

Daily Record Bingo sister sites include:

Bingo Daily was launched back in 2014. Cashcade Network owned it, and it was powered by Globalcom software/888 Group. As technology advanced over time, more people started playing games online. Hence a better deal of up-to-date technology sites emerged. They even came with better features and themes. Sadly this led to the collapse of the Network.

Daily Record Casino then migrated their games to the Virtue Fusion bingo sites, which Trinity Mirror Group owns. Soon after, the Network also collapsed. But, lucky, they found a home in Jumpman Gaming. Hopefully, this is the last time they have migrated.

Daily Record Casino is under the United Kingdom Gambling Commission, and its Alderney Gambling Control Commission license also licenses it. Both governing bodies are the best regulators in the gambling industry. For Daily Record to be part of it, they have gone through strict testing to earn the license.

Daily Record Bingo’s software provider is Jumpman Gaming. It supplies the site and its sister sites like OK! Bingo, New spins, and Mirror Bingo with excellent games.

The provider offers one of the latest titles at 75, 80, and 90-ball bingo games. They include Bingo Millions and Fun Friday Bingo on both desktops and mobile devices.

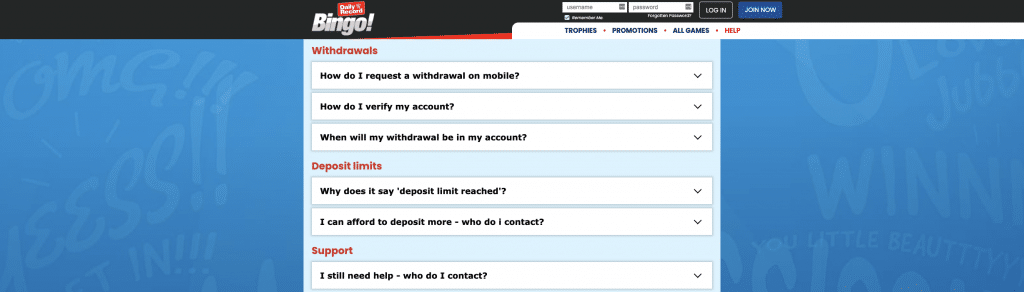

Daily Record online bingo tries to provide as much information on their site. This is to help you deal with everyday problems without directly talking to the customer service team. However, if you can’t find what you’re looking for, you can contact the team via telephone or send them an email,

Email: support@dailyrecordbingo.com.

Daily Record Bingo has a much-improved site, unlike when it was first launched in 2014. It features 20 no deposit free spins bonuses that you can play on Starburst. It doesn’t cost you to test the waters and see what Daily Record Bingo can offer you.

Daily Record Bingo is home to a fantastic selection of games and great ongoing promotions. The theme and graphics of the bingo rooms are worth being part of.

As usual, nothing is 100% perfect, and Daily Record Bingo has some downsides. The wagering requirements are on the higher end, and there are also other withdrawal restrictions, like a £2.50 service fee. However, if you look at the bigger picture, it’s nothing like what you’ll gain. You’ll enjoy playing the games, and it’s worth your time.