Looking for a casino to light up your life? Then, you’re in the right place! Read this review to find out all there is to know about Light Casino.

Looking for a casino to light up your life? Then, you’re in the right place! Read this review to find out all there is to know about Light Casino.

Light Casino is a fantastic creation of Romix Limited, popular for creating many other top quality online casinos. It was launched in 2019, which makes it relatively new to the online gaming world, but it is already among the best online casinos you can ever find in the industry.

Light Casino has a versatile game selection from top industry software suppliers, which has boosted the quality of games on the site. The casino games are top-notch, which has increased Light casino’s popularity and attracted many players.

Besides that, the casino has a welcoming and nicely designed instant play site that gives you an easy start. The user interface of Light casino also has many filtering options that make your navigation on the site easier.

If you enjoy Light Casino, check out these new casino sites that we have reviewed!

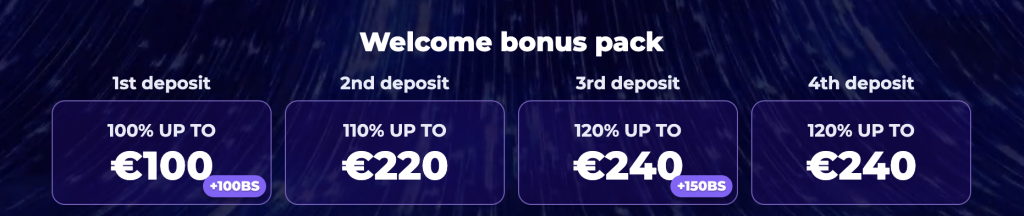

Light Casino has an awesome welcome bonus offer for all new players at the site who have signed up and made a qualifying deposit. The casino welcomes new players with a 100% match-up bonus offer of up €500 and 200 free spins.

But you need to first make a qualifying deposit of €20 or more, and the bonus is automatically credited to your account. Light casino also gives you free spins in 10 days, whereby you earn 20 free spins daily.

Light Casino is a generous online gaming spot because it rewards both new and returning players with lots of free spins in its various promotions.

New players are rewarded with 200 bonus spins on their first deposit at the casino in the welcome bonus promotion. This unique online casino rewards 50 bonus spins in the weekly reload bonus and the other 50 bonus spins in the weekend reload bonus to both new and existing players.

But you have to first make the needed qualifying deposits for receiving the free spins, and you have to wager your winnings from them 40x.

| 🔴 Site Name | Light Casino |

| 💋 Owner | Maltix Ltd |

| 📊 Markets | Casino, Slots |

| 😘 Welcome Offer | UP TO €500 + 200 FREE SPINS |

| 💳 Minimum Deposit | €20 |

| 🔥 License | View |

| 📅 Founded | 2019 |

| 🏪 Software | Evolution Gaming Casino Microgaming Casinos NetEnt Casino |

| 📪 Address | Level 2, |

| 🔗 Website | https://lightcasino1.com/en/ |

| ☎ Phone Number | +35627369050 |

| support@lightcasino.com | |

| 😍 Sister Sites | |

| 💰 Deposit Methods | Neteller |

You need to meet a wagering requirement of 35x your bonus amount and initial deposit to be in a position of cashing out your bonus and winnings from it.

For example, if you deposit €40 and earn a 100% match-up bonus of €40, your bonus wagering requirement at Light casino is 35 x €40 + €40 = €2,800

But your winnings from the given 200 bonus spins are subjected to a wagering requirement of 40x.

Light Casino doesn’t currently offer no deposit casino games to its players. It has lots of free games but to receive them; you need to first make the needed qualifying deposit.

If you deposit only €20 at the casino on your first deposit, you are rewarded with 200 free spins for gameplay without using your deposit.

Best of all, Light casino has a demo play option for most of its games. You don’t have to download or register to try out the games. But you only have to check the games available for demo play at the casino, and you try them out.

This amazing online casino doesn’t only stop at rewarding you on your first deposit. But it also has various ongoing promotions and casino bonuses that reward you as you continue playing at the casino.

Here are some of the ongoing promotions at the casino;

This is a great promotion through which Light casino partners with Pragmatic play to reward you prizes that are worth €9000. This promotion runs from Thursday to Wednesday every week. You can opt for the promotion via one of the listed qualifying games.

In this casino promotion, you are given a golden opportunity to receive 50 free spins to enjoy on your favourite slots. It is available on the first deposit you make each week, and it runs from Monday to Thursday. The minimum qualifying deposit needed is €20, and you must use the free spins in 7 days.

Light Casino rewards you with a 15% cashback of up to €3000 every week. The promotion is for only players in the top three levels of the casino’s VIP club, and it runs from Monday to Sunday. Players in the 3rd VIP level receive 5%, 4th level 10% and the 5th topmost level 15% cashback.

This promotion is specifically for live casino players, and you are rewarded with a 10% cashback of up to €150. The promotion runs every week from Sunday to Saturday, and the cashback is credited to your real cash account and subjected to a 1x wagering requirement.

Light Casino celebrates the weekend with you in this promotion. The casino rewards you with a reload bonus of up to €700 and 50 free spins. This bonus applies to your first deposit on Friday, Saturday and Sunday, and it has to be €20 or more. The casino must use the free spins for gameplay on particular selected slot games.

You need to regularly check the promotions area for more ongoing promotions and bonuses at Light Casino.

Light Casino treats every member as a VIP because its VIP Club is for every player. The moment you sign up at Light casino, you automatically enter the first level of its 5 tier VIP Club.

The casino rewards you with various loyalty points on each bet you make on the different casino games.

The more points you accumulate, the higher are your chances of moving from the lower tiers to the top ones. The higher your level in the VIP club, the more perks you get from Light Casino.

You are rewarded with a casino cashback bonus of up to 15% in the third, fourth and fifth levels plus higher monthly payout limits above the usual limit. Light Casino also gives you a personal account manager in the top tiers to personalize your experience at the casino.

Light Casino is a mobile casino site with an excellent interface that gives you a seamless experience like its desktop version. The mobile version is compatible with many mobile devices like smartphones and tablets, which enables you to access the casino while on the go.

Light Casino’s mobile version is also supported on different operating systems like Android, iOS and Windows. So you need an internet connection on your mobile device no matter its operating system, and you access Light Casino via your favourite mobile browser.

For more Android-compatible casino sites, follow this link.

Best of all, the mobile casino has lots of top-quality games in store for you. You can also receive all the casino’s ongoing promotions and bonus offers on Light Casino’s mobile version.

Light Casino doesn’t currently have any dedicated mobile app for download. But when it launches like many other online casinos, Light Casino will communicate to its players and the public.

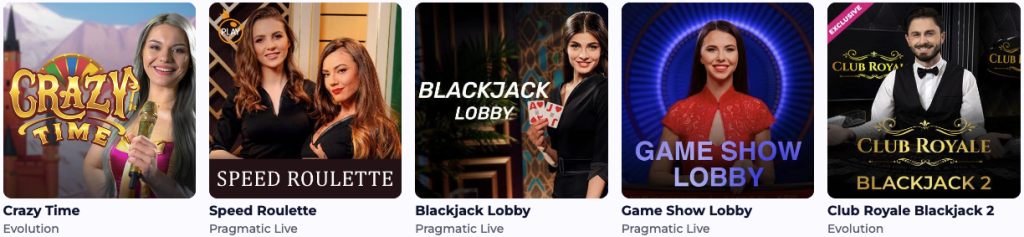

Are you a live online casino fan? If you are, then Light Live Casino is your place to be. The live casino has an excellent collection of games that are over 70 and can rarely be found in many other online live casinos.

The live games are also top-notch because they are powered by top companies like Pragmatic Play and Evolution Gaming. So you are assured of the best and high-quality live stream of the games from some of the best studios in the industry.

Here are some of the live games at Light Live Casino:

Light Casino has a huge collection of the best slot games in different categories, such as jackpot slots that are appealing to high rollers because of their big jackpot offers. It also has new, popular and classic slot games of all time.

The slot games at the casino are also in different amazing themes that boost your entertainment like movies, Fantasy, magic, fairy tales, fruits, Egyptian, adventure and Japanese among others. So no matter your favourite slot theme, Light Casino has something for you.

Here are some of the slot games at the casino:

The online casino games software providers at the casino are over 30 and provide a variety of slot machines at the casino. This is because you have many amazing online slots titles from different suppliers, which boosts your taste.

The popular slots software suppliers are among the most reputable, popular and trusted companies known for creating top-notch games. Their games have high-quality graphics, favourable return to player percentages and highly rewarding special features.

This is a guarantee to boost your entertainment and your winning chances because the high RTPs of the slot games give you a winning edge.

Here are some of the slots software providers at Light Casino;

Light Casino doesn’t only have slot games in its game collection, but it also has lots of top-quality casino table games that give you an unmatched new taste of games. You don’t have to leave the casino in search of new great tastes in games because you have to move to the table games section.

Industry leaders power the table games collection, so the best quality games are guaranteed in the collection. It also has unique variations of the popular classics like the best online blackjack and top online roulette, you will also find Baccarat and some excellent online video poker.

You will also find many new table games you can ever find in the online gaming world.

Some of the selection of table games at Light Casino include:

Light Casino has many reliable, convenient and popular casino payment methods for smooth transactions on your deposits and withdrawals.

This unmatched online gaming spot offers you many deposit methods from which you are free to choose any of your favourites. You have the power to choose a fast deposit method with fewer service charges from the many provided.

Here are the deposit channels at the casino;

On top of the many deposit channels, Light Casino also gives you a variety of withdrawal channels to choose the best for your cashouts. The best withdrawal method must be fast to deliver your cash on time and have zero or fewer service charges to deliver your money in full amount.

Each withdrawal method provided has its waiting time to deliver your money, and you should go with one with a fast withdrawal casino method with a short waiting period.

E-wallets at Light casino take only 24 hours to deliver your money, while Bank Transfers and Card payments take the longest time between 3 to 5 days.

The casino has a pending time of between 0 to 5 days, and the maximum withdrawal is €500 daily and €10,000 per month.

Customer Support. Light Casino has a robust customer support team because it provides you with various communication channels to use any time you want to keep in touch. You can use the provided support email, telephone number or the live chat platform, which provides timely replies and is 24/7 active.

Licensing. The casino’s operations are licensed and regulated by the Malta Gaming Authority. This is a trusted body in the online gaming world, and it legalizes the operations of various online casinos. This means Light casino is a legalized entity and a safe gaming spot.

Game quality. All the games at Light Casino, including table games, live games and slot machines, are powered by industry leaders. This means that you are guaranteed top quality games in all the casino’s game collections, no matter your favourite game type.

Fairness. The games at Light Casino have been tested for fairness, and the casino’s random number generator has been checked and certified for fair play by the responsible authorities. So there’s fairness in all the casino games.

Payment Methods. The casino also provides many trusted, convenient and popular payment methods, enabling you to make secure deposits and withdrawals at the casino. Best of all, no case about non-payments has been recorded against Light Casino, so you are assured of a smooth withdrawal of your winnings.

Light Casino, provided by Romix Limited, is a one-stop centre for all your online gaming needs. Besides the top-quality game collection, the casino has lots of ongoing promotions and offers for every player, whether you are a new player or an existing player.

The casino rewards both new and existing players with lots of cashback, free spins and match-up bonuses in its bonus offers. You have to join the casino and make the needed qualifying deposits for the particular promotions.

In addition to that, Light casino has an unmatched VIP club for all its players. The VIP club has 5 tiers with many rewards in each, and the more you deposit and play at the casino, the more points you receive to climb to the top levels with the best perks.

According to our review of Light Casino, we highly recommend it to you for a fantastic gaming experience.

Light Casino doesn’t currently have a mobile app in place. But you can access it via its web-based version using your ideal mobile browser as long as your mobile device has an internet connection.

Light Casino has a bonus wagering requirement of 35x your initial deposit plus your bonus amount for your deposit bonuses.

It also has a wagering requirement of 40x for your winnings from the free spins.

Light casino is licensed and regulated by the Malta Gaming Authority.

So this fantastic online casino legally operates in the online gaming world, and you shouldn’t worry about its legality.

This unique online casino doesn’t currently have any no deposit free games. First, you need to make a qualifying deposit to receive Light Casino’s free games.

But you can embrace the demo play provided on the various casino games and try them out without making a deposit.