Space Wins is a user-friendly and fun-themed online slot site with a wide selection of slots for users. The site provides different casino and bingo games, and the number of slots available is highly impressive.

Space Wins is a user-friendly and fun-themed online slot site with a wide selection of slots for users. The site provides different casino and bingo games, and the number of slots available is highly impressive.

The site’s graphics are commendable, giving players a good feel for playing slot games. Interestingly, there are no complaints about fraud and malpractices on the website.

This Space Wins review will enlighten you on the casino offerings, including free spins welcome offers and special promotions.

[toc]

There are fantastic bonuses available for new players on the site. As a new player, you will enjoy 5 free spins no deposit required on the Starburst slot game. Bettors can hit big on Starburst and claim as high as 500 free spins on the welcome offer.

Lucky Star stands as one of the most significant promotions on the website. It’s open for new players that make at least £10 as a deposit on the platform.

The welcome bonus on the platform is different from other similar casino sites. When new players register and activate debit cards, they can enjoy the no deposit bonus. Please note that the welcome bonus is straightforward to claim.

In the meantime, the site doesn’t require any specific bonus code to claim the ground offers. The platform provides the promised deal as soon as the player meets the wagering requirement and other requirements.

Impressively, the site hasn’t ignored the importance of free spins. Players can get 5 free spins on card registration without needing to deposit. Please note that this offer is only for the new players on the website. All new players should ensure they undergo a valid debit card verification to earn this bonus.

| 🔴 Site Name | Space Wins |

| 💋 Owner | Jumpman Gaming |

| 😘 Welcome Offer | 5 Free No Deposit Spins |

| 💳 Minimum Deposit | None |

| 🔥 License | View |

| 📅 Founded | 2019 |

| 🏪 Software | Jumpman Gaming |

| 📪 Address | Inchalla |

| 🔗 Website | spacewins.com |

| Email: support@spacewins.com | |

| 😍 Sister Sites | |

| 💰 Deposit Methods | Debit card, Paypal, Paysafecard and Pay By Mobile |

The primary concern about the platform’s bonus offer is the wagering requirement that the players must reach. All new players must meet the 65x wagering requirements for this site to claim the bonus.

The wagering requirement for this site is undoubtedly steep, but there are many Amazon vouchers to win. All new players should also fall within the legal age for betting, 18 years and above.

Luckily Space Wins has a no deposit slot bonus available for new players. The welcome bonus gives players 50 free spins on starburst without needing to deposit.

There are several ongoing promotions and offers present on the platform. The current ongoing promotions and offers are the typical happy hours, interactive trophies game, and bonus spin offers.

Ensure that you regularly check out the promotion section on the platform, as there might be a few sudden changes. If you cannot check regularly, you can allow email updates for personalised deals.

This platform requires players to work their way up to claim the player rewards and earn a VIP promotion. There’s a loyalty scheme on the site that consists of five tiers. Hence, the higher a player goes, the more cashback earned. All players begin as Newbies on the platform, then move up the ladder to Expert, Pro, and VIP before the final legend step.

Before a player makes it to Expert in a month, it takes £100 of wagers. However, players must bet £20,000 monthly to get to the Legend position. The daily cashback bonuses provided serve as the most significant perk in the loyalty program.

All new players earn double cash back for 31 days after registration. Hence, Newbies begin at 1% daily cashback but can reach 20%. The VIP Promotion and Player Rewards are unique to the site, making it fun to participate.

In this Space Wins casino review, you will find that the site is a fantastic website with a premium user interface and colour scheme. The platform is built on a bright purple space theme with other similar colours. It’s safe to say that the website idea was an intergalactic approach.

The platform’s logo is attractive, including all the graphic designs on the various pages. The structure makes navigating through the site easier for new players.

The available Space slot games on this site are an essential point to consider. Players can enjoy several slot games on this top slot site as of this time of writing. Fortunately, the slot games present are the leading games in the industry.

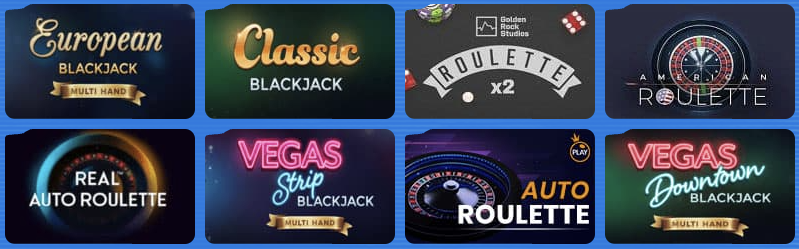

Other casino games are not very common. Significant examples of the available slot games are:

Players looking to win massive cash can go for the jackpot slots and play games like Mega Jackpot, Mega Moolah, and Sugar Train.

Most Space slot game providers are reputable in the gambling industry, and experienced players trust these providers. The available providers are present to ensure that the available games are the best. One of the notable providers is Netent slots software. Here’s a list of the slot games providers:

The casino games present on the platform are exciting. Space Wins provide some of the best games. However, the number of casino games is not so high. The casino games are video poker, roulette, top online blackjack, and European roulette.

You can play these games with a browser and use the full-screen feature. Players get to pick a nickname and engage in a live game with other players around the globe.

Playing on mobile apps is one of the essential things that online casinos consider. In the meantime, there is no downloadable app for users; however, players can visit the mobile slot site directly to enjoy the available offers.

Impressively, the absence of Space Wins mobile apps doesn’t stop it from functioning magnificently. All players can head to the website using their smartphones or tablets. Please note that the user experience is perfect for Android and iOS users.

The navigation on the website is top-notch, and the links and buttons are clear and understandable. Hence, it will be easy for players to navigate through the website.

Every platform should have enough withdrawals and deposit methods. Space Wins doesn’t have many slots payment options available for players. However, the methods of payment and depositing present are entirely reliable, such as PayPal and Paysafecard.

Each method for deposits and withdrawals has different processing times, minimum withdrawal amounts, and fees. The site operates using the GBP currency. So, players that don’t use the same currency need to make currency conversions.

Here are the available methods to fund your account:

For withdrawal, here are the available methods:

The banking methods in the platform are all reputable and can be trusted. They request Identity and address verification typically. You must provide proof of payment method on the site to enjoy withdrawals and deposits.

The makers of Space Wins operate several other online gambling sites. Besides, these sites seem to provide different deals, some of which are similar. Interestingly, they also offer identical payment methods for players.

Here’s a list of the sister sites:

Jumpman Gaming is the parent company of Space Wins. The owners are known to operate other casinos doing well in the gambling industry. Besides, they appear to pay adequate attention to crucial details to improve user experience.

Currently, the site has an affiliate program called the Jumpman Affiliates. The company doesn’t have apparent celebrity endorsements, sponsorship deals, or awards.

The licensing of any online casino is crucial. Without proper licensing and registration, the platform will not have the right to operate in certain regions. Jumpman Gaming is licensed in two jurisdictions, allowing players from every area worldwide.

In the United States, the platform is licensed by the UKGC (United Kingdom Gambling Commission). A license with the UK Gambling Commission means a lot to players and proves that the site is well regulated.

UKGC is considered the strictest regulatory body for UK players. The site also holds a license from Alderney Gambling Control Commission, which permits operation in different regions.

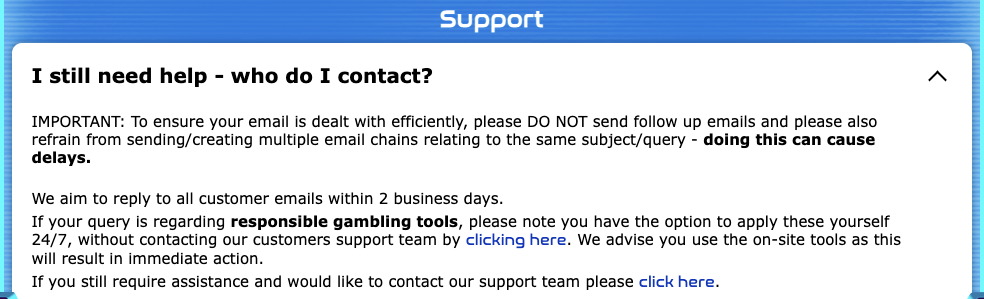

When discussing this site’s overall operation system, it’s undoubtedly impressive. The available promotions and bonuses are suitable for new and experienced players on the site. However, the primary aspect to consider is the support details of the site.

The support seems to focus primarily on registered members of the platform. If you’re trying to reach out to customer service without an account with the site, you may face challenges, but this may not be a problem for many people.

Space Wins provides a section for FAQs; this part of the site gives valid answers to common questions that customers may ask. So, before asking any questions, account owners and non-account owners can check out the common questions on the site.

Aside from a section for Frequently Asked Questions, you can contact the customer support team via email. Players can get responses to their questions and complaints via their email. The company’s email is support@spacewins.com.

Impressively, there is an opportunity to contact support through Facebook (Live Chat). Hence, players who can’t reach them via email can do so through social media. However, this option is more suitable for account owners who request a username and date of birth.

Overall, Space Wins is an impressive platform for playing slot games. New players can trust the platform because of its strong reputation. The bonuses and promotions provided by the site are exceptional. However, the wagering requirement is much higher than on similar platforms.

There’s no dulling moment on the site, thanks to the constant VIP promotions and player rewards. Players can enjoy many slot games on the platform, but the live games are minimal. As a site that gets its licensing from UKGC, you can trust the security and fairness of the platform. Hence, we can confidently say playing slots at Space Wins is highly recommended.