The site is jam-packed with daily and seasonal offers that every player yearns for. There are some additional perks for long-standing loyal members.

This Pots of Slots review will disclose all the mysteries on the other end of the casino rainbow. How many pots of gold you can gain and where to find them. Read till the end, and the riches this UK slot site possesses will amaze you.

Pros & Cons

PROs

- Promotions Full Of Free Spins

- Range Of Popular Slots

- Multiple Payment Options

- Easy To Use Site

CONs

- No Live Chat Option

- High Wagering Requirements

[toc]

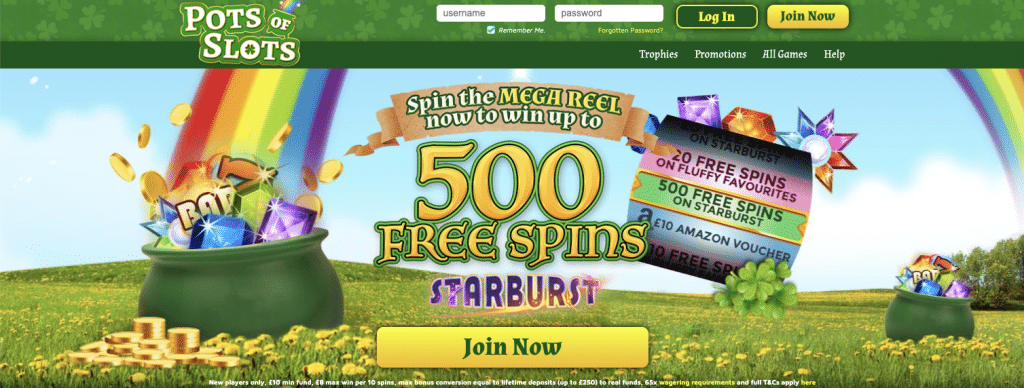

Welcome Offer & Sign Up Bonus

Generous welcome bonuses are the highlight of Jumpman’s online casino. Following the tradition, Pots of Slots have some exciting prizes for its potential players on their first sign-up.

How to receive the Welcome Offer

Pots of Slot’s generous welcome offer is a great head start for recruits. The upcoming promotion becomes much more enthralling after such a warm welcome.

The first step is to register for the online casino. A few seconds of registration forms with specific information is all it requires for earning official status. It takes a few seconds to verify the player’s account.

Log in to your account and claim your welcome bonus by depositing at least £10 in your casino account. Players also get an upgraded welcome bonus message with a special Pots of Slots promo code.

Welcome Bonus

Once your deposit is verified, it’s time to spin the wheel. A colourful Mega Reel will pop up on your screen. The casino loads each Reel section with fantastic prizes, which means there is something for every player.

Potofslots reset their featured slots games every month. These video slots make up the rewards for the Mega Reel, and players get free spins on the qualifying video slot games. At the time of writing, the month’s featured games are Starburst slot and Fluffy Favourites.

Starburst is a fantastic slot game, and players get a chance of 500 free spins on the slot game. The video slot has a significant multiplier that boosts the chances of winning.

Players can also receive a free spin on Fluffy Favourites and win exciting bonuses. There is also an Amazon Voucher worth £10 awaiting on the wheel if that’s not enough. If you think this is the end of Mega Reel in the casino, you are mistaken. The prize wheel enters from time to time. Keep reading this review and know some secrets.

The site credits free spins to players’ accounts when they win on Mega Reel. The winning spins are collected as bonus funds on the casino. It’s the player’s choice to use bonus funds or real cash for playing games.

Amazon vouchers are emailed to the member’s registered accounts. The casino’s estimated time for delivering coupons is seven days.

It’s important to know that not all spins result in prizes. No doubt, the casino algorithm ensures all new players win a prize. However, sometimes your luck takes a break at the wrong time and leaves you with nothing.

Pots of Slots offer lots of promotions and trophies for players. However, members don’t have to type any special promo code to participate. Click on the Play Now tab under every promotion and start playing.

New players often see a message from the casino for an upgraded welcome offer. Players have to add an UPGRADED promo code to claim the offer. The offer remains in the personal inbox for only 24 hours. If you miss the offer, it will not reappear again.

Free Spins

Players who love to gamble online can feel their pulse pumping with every spin of the reel. When you get these spins at no cost, the fun doubles, Jumpman network casinos are jam-packed with a promotion offering free spins and many other bonuses.

Players get 50 free spins on 1st deposit as a welcome offer. There are plenty of daily and monthly promotions rewarding free spins to players ranging from 10 to 50.

Players can also get a chance to spin the Turbo Reel and win amazing prizes. To unlock the Turbo Reel, players must deposit £100 or more. Each segment of the reel has boosted prizes ranging from 5 to 50 free spins.

There are plenty of other free spins offered in the promotion section, such as no wagering free spins and no deposit free spins. Visit the promotions page frequently to claim the free spins.

Pots of Slots Wagering Requirements

Wagering requirements are the least favourite feature of the players on online casinos. They are barriers between players and their winnings. But they are essential for safety on online gambling sites.

Pot of Slots is a Jumpman casino that has slightly higher wagering requirements. There may be casino websites with low wagering requirements, but Pots of Slots provide a safe and fair platform. It’s worth paying wagering for your bonus funds that come with little investments.

It depends on your opinion and preference, whether the welcome offer is fascinating enough to keep playing.

Pots of Slots wagering requirements

- Free spins from the welcome offer are available for a limited time of seven days.

- All free spins winnings are credited to players as bonus funds.

- Players cannot withdraw bonus funds without fulfilling the wagering requirement.

- Pot of Slots has restricted winning amounts on free spins. The maximum winning amount for ten free spins is £8.

- The wagering requirement for bonus funds is 65 times the sum of bonus funds and remaining wagering requirements.

- Real money does not contribute to the wagering requirement.

- Only bonus wages count towards completing wagering requirements.

- Withdrawing without completing the wagering requirement

- Some games do not contribute to the wagering requirements. The games list includes.

- All variants of blackjack

- All variants of Roulette

- Progressive slots

- Casino style games

- It’s easy to track wagering requirements by visiting the withdrawal page.

No Deposit Slots Bonus

At the time of writing, there aren’t any no deposit slots bonuses available to players at Potsofslots. These bonuses are difficult to find due to how rare they are. However, Pots of Slots may introduce a no deposit bonus in the future.

Rating

Has some of the top slot games all players love!

The site’s great layout helps players navigate to find their favourite games.

Our Scores

BONUSES & PROMOTIONS 3.8*

DEPOSITS & WITHDRAWALS 4.0*

Players often get disheartened with the 65-time wagering requirement. But there are plenty of exciting promotions that keep players coming back for more.

After the generous welcome offer, it’s time to open the promotion section and start playing. The page features more than ten promotions consistently, and some are daily or weekly offers; others appear occasionally.

December to Remember

To make your Christmas merrier, Pot of Slots offers its players amazing prizes.

- Players can have time to win.

- Three iPads

- 2 LG OLED 4k TVs

- 3 Bose Sound Bars

- 4 iPhone 12 Pro’s

- Wager £10 or above on the following games to win:

- Better Wilds

- Penguin Vacation

- Santa Surprise

- Selfie Elfie

- An extra wager of £10 on the qualifying games within the promotional period earns an additional entry in the draw.

- The cash may opt for actual money.

- Cash prize alternative for Apple iPhone 12 Pro 128 GB Graphite is £1099

- The real cash alternative for Bose Tv Speaker Bluetooth soundbar is £239

- Natural cash alternative for LG OLED 4k TV 55″ £1399

- Cash prize alternative for Apple iPad 32 GB is £329

- Pots of Slots contact winners within seven days of the promotion expiration through email.

Free Spins of the month

- Promotions include prizes from 20 to 500 free spins.

- Qualifying games for the promotion are

- Sweet Bonanza Xmas

- Christmas Carol Megaways

- Players have to deposit £20 in the promotional month to qualify for the promotion.

- Qualifying slot games are reset every month.

Birthday Bonus

- Pots of Slots value its customers and celebrate their big days with exciting treats

- Birthday is a big deal for everyone, so why not celebrate with a blast?

- Pots of slots offer birthday players a free spin on the Mega Reel.

- It’s essential to log into your account on your birthday. It’s a one time offer that vanishes the next day.

- Mega Reel provides players with a chance to win up to 500 free spins.

- Only funded players can claim this offer.

Happy Hours

- Pots of slots love to entertain their players with the idea of happy hours.

- The extended time frame for happy hours is from 3 to 7 pm

- Ten free spins every Wednesday during happy hours

- Players have to log in to their account within the given time frame.

- Qualifying slots reset every Wednesday it gives players a chance to try new shots and win big.

Daily Cashback

- Pots of Slots support their players in every dilemma.

- Losing money on casinos is a hard fact, and players lose hundreds or even thousands every day.

- Pots of Slots don’t let its player lose heart, and thus the casino offers a cashback offer.

- You can claim 5% cashback in your account daily.

- Visit your account page and claim your cashback for the day.

- Daily cashback is a calculated percentage of the player’s daily deposit. It does not include requested withdrawals and the current balance on the account.

- The cashback amount is credited as real funds in the player’s account.

- No wagering requirement was applied to the cashback offer.

Winner Winner Chicken Dinner

- Pots slots provide not only amazing bonuses but also tasty takeaways.

- Every month players win Just Eat £50 Voucher.

- Players with the biggest win on a single free spin get selected for the bonus.

- The player with the highest spin wins all over the Jumpman casino network earns the voucher.

- Online casino contact players through email within seven days of the last month-end

- The voucher will be sent through email.

- Players cannot exchange vouchers for cash.

Pots of Slots is a Jumpman venture and adopts its VIP scheme, among other features. Players can climb through 5 levels and earn trophies for completing different challenges.

- Level 1 to 5 players can win five or more free spins.

- Level 6 to 10 players can win ten or more free spins.

- Level 11 to15 players can win 15 or more free spins.

- Level 16 or above players can win five or more free spins.

Collect five trophies and unlock a new VIP level

Players get to spin Mega Reel as a reward. Maga Reel awarded for trophies is only available for players who have funded the previous two days.

Pots Of Slots Review

User-friendly interface and aesthetically pleasing website are trademarks of Jumpman casinos.

Pots of Slots is the epitome example of simplicity. No flashy animations or slideshows that introduce new promotions. The fun theme of the website looks pleasant and appealing with its fresh colour theme, and green and yellow are the primary colours that compliment the Irish casino theme. All the props on the homepage remind you of leprechauns and the magic world.

The background shows blue skies, Irish sea and a yellow flower field with a rainbow. Two pots full of gems and gold represent plenty of bonuses on the themed slots site. The top and bottom navigation bar illustrate clover as a backdrop to wish players good luck for their slot adventure.

It intrigues members with the welcome bonus of 500 free spins with a Mega Reel prop in the middle of the screen. A big Deposit tab under the welcome offer encourages members to click and start playing.

Pots of Slot’s logo is green and white with a yellow outline, and a pot with a rainbow shooting from inside looks fascinating.

Pots of Slots have a flawless desktop website that works and operates smoothly with excellent loading speed. However, whether the casino supports a mobile site or app is still a secret yet to be revealed.

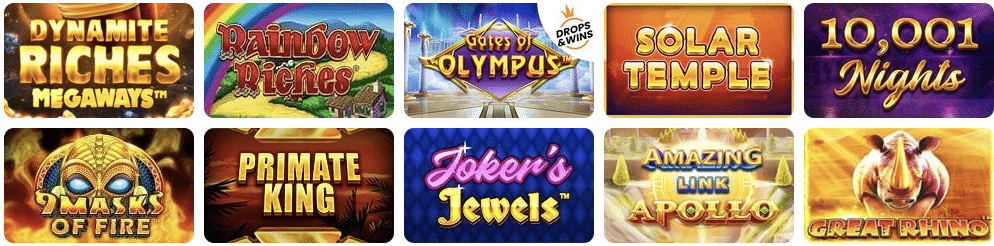

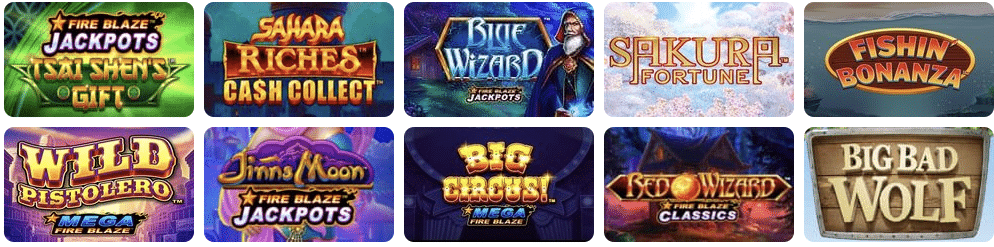

Slot Games

Pots slots have a massive collection of slots titles. Players can find all their favourite titles in a well-organised section for easy success.

Popular slots like Starburst, Fluffy Favourites, Rainbow Riches, and Diamond Kings are most sought after. You can also find featured games like.

Progressive Jackpots are popular among players to win big prizes. Some top titles in the category are

- Caravan to Cairo

- Fluffy Mega Jackpot

- Unicorn Bliss Jackpot

- Stampede

- 99 times

Slot Game Providers

A primary reason for Jumpman casino’s popularity is the availability of games from top providers. You can find titles from the biggest software developers in the gambling industry including NetEnt slots. However, there are some new additions over time.

- Microgaming

- Next-Gen

- Elk Studios

- NYX Gaming

- Chance Interactive

- Quickspin

- Foxium

- iSoftBet

- IWG

- PariPlay

Casino Games

Pots of Slots is not only a focused slot casino. The online casino has many other titles related to live dealer games, Blackjack, Roulette, baccarat, etc.

After slot games, the highlight of the site is its live casino. These live casinos provide a real casino vibe and interest players with the social aspect of the casino.

- Live Blackjack

- Live Roulette

- Live Speed Roulette

- Live Blackjack A

The table games categories include all variants of Roulette and Blackjack. This top roulette site has games such as:

- American Roulette

- European Roulette

- European Blackjack

- Solitaire

- Classic Blackjack

- Atlantic Blackjack

- Mega Reel

- 20p Roulette

Pot slots also offers bingo games in the casino, which many players find interesting. Each game is displayed with the next game time, players, and total prize.

Bingo Millions 75 Ball Instant – Total prize: £1.0 million

90 Ball Bingo – Real prize: £4372

Bingo Million – Total prize: 1.5 million

Heavy Weight – Total prize: £4373

Play on Mobile & Pots Of Slots App

Jumpman Gaming site provides its players with an outstanding gaming experience on desktop and mobile browsers. Unfortunately, there is no app for the top mobile slot site.

The browser version of the casino is compatible with all iOS, Androids, and Windows and tablet devices. Gaming advocate recommends Chrome as the best browser for online gambling, and iOS and Android devices both have chrome apps in their respective virtual stores.

Pots of Slots is fully optimised with the mobile device providing players with a smooth and fully functional gaming experience. The layout of both versions is almost the same, and the desktop version has features on the landing page, whereas they are compressed in a menu toggle icon on the browser.

Some players find the app’s absence convenient, as there will be no downloading hassle or lagging incidents.

Payment Methods & Depositing

As part of a robust Jumpman network, funding on Pots of Slots is convenient and secure. Players can make deposit transactions with no nuisance. Registered players can log in to their accounts and deposit through their preferred slots payment method and banking options.

Payment Options:

- MasterCard

- Visa Debit Cards

- Maestro

- Paypal

- PaySafe Card

- Pay by Mobile

Pots of Slots minimum deposit is £10, and the casino does not charge any deposit except on Pay By Mobile.

Players using the Pay by Mobile method have to incur a £2.50 fee on £5, £10, and £20 deposits.

There is no restriction or limit for withdrawal amount on the site. However, players have to pay a £2.50 fee for cashing out.

Seventy-two hours pending period is required for each transaction during which players can cancel their request. The waiting period for cashing out varies with each payment method.

Pots Of Slots Sister Sites

Pots of Slots sister site are mostly similar in features, but the welcome bonus and specifications differ from one casino to another.

- Fever Slots

- Slot Machine

- Club 3000 Bingo

- Volcano Bingo

- Olive Casino

Who Owns The Site?

Jumpman Gaming Limited operates Pots Slots. The company has extended experience in the online gambling industry, and its casino is popular among gamblers for its straightforward interface and compelling promotional features.

Jumpman Gaming has partnered with some influential software developers in the gaming industry. These gaming providers have a reputation for creating high definition games with detailed features.

The company has an impressive affiliate programme that provides its affiliates with a 50% incentive for advertising. At present, over 100 brands are advertised on different websites.

Some prominent Jumpman sites are

- Target Slots

- Avenger Slots

- VIP Spins

- Irish Slots

- Incredible Spins

- UK Slot Games

Licensing

Pots Slots is the venture of the powerful Jumpman Gaming network, which holds a license from robust regulators.

The network holds a United Kingdom Gambling Commission license within Britain and an Alderney Gambling Control Commission license outside the UK.

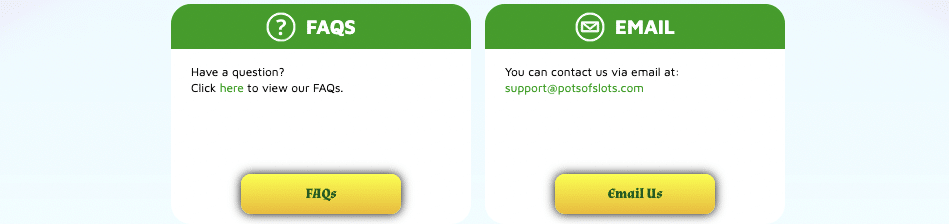

Support Details

Customer support service is a crucial segment of any online website. Players feel safe and comfortable, knowing that the customer support team is efficient enough to solve their problems. Pots of Slots have a proficient customer support team that assist players with casino related queries.

The first stop to find the answer to issues players may experience is the FAQ section. Fortunately, players can see a comprehensive FAQ page that features answers to general questions.

Players can also send their feedback or queries through email at support@potsofslots.com. The customer team promised to reply within two working days.

Queries relating to responsible gambling have a separate section which could be reached through the Pots of Slots website.

Final Thoughts

Jumpman Gaming brand is a trustworthy brand in the gambling industry, and gamblers trust its ventures with their money.

The exceptional promotional and splendid features keep players entertained on the site for a long time. The site features a simple layout, user-friendly navigation, excellent optimisation, and a professional customer support team. These features are enough to intrigue gamblers to join the casino website and start winning big cash prizes.